J. Lyons Fund Management, Inc. Newsletter

| December 2012/January 2013 |

Posted January 22, 2013 |

| Tweet |

|

Unhappy New Year!

The stock market is at a 5-year high...so why is everyone so unhappy?

“Change,

like sunshine, can be a friend or a foe, a blessing or a curse, a dawn

or a dusk."

- William Arthur Ward

In these tumultuous times, so much divides us it is common thought that the politicians in Washington (or wherever) don’t care about us, the seemingly voiceless, back at home. I actually see it a different way. Simply put, it appears to me that the divide in ideology is so great that compromise is not an option. In a review of our history, it appears that this divergence in ideology has not been this great since the Civil War and the Reconstruction Era that followed. Our problems here in the U.S., together with the battle going on to rescue much of Europe from the depths of financial ruin brought on by unbridled entitlement spending on the part of left leaning governments makes our investment environment perilous to say the least.

Combine

that with the amount of stock trading that is being done by entities

whose activity is driven solely by computer-driven algorithms. Believe

it or not, millions of dollars are actually being spent to build a

network to reduce a New York-Chicago round trip trade transmission from

15.9 milliseconds to 13.1 milliseconds for such trading. These

computer-driven trades may generate more than 50,000 trades a day,

albeit in small numbers of shares. The potential perils of such “high

frequency trading” is an unknown at this time but certainly contributes

to the stock market being quite a different place than it used to be.

Finally, add in the fact that we likely still have several years to go before we exit this secular bear market and you have an environment that has greater than normal latent risk, not to mention many less-than-happy constituents.

Disclaimer: While this study is a useful exercise, JLFMI's actual investment decisions are based on our proprietary models. Therefore, the conclusions based on the study in this newsletter may or may not be consistent with JLFMI's actual investment posture at any given time. Additionally, the commentary here should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies.

Reacquainting With the Concept of Risk

We frequently state that we agree with Warren Buffett’s comment that the first priority in investing is not to lose money. That position was summarized in our October 2010 Quarterly Client Letter as follows:

"Although

our overriding goal is to make money for our clients, the emphasis must

change with the environment. A hiker in the mountains on a bright and

calm sunny day will accept the undertaking of more accelerated

accomplishments but on a stormy one should be much more defensive and

willing to seek cover. So we too think it prudent to adjust our

willingness to be aggressive during more hostile climates. As we have

discussed often on these pages, we feel we are in the middle of a

secular (long-term) bear market and as such are less willing to be as

aggressive on the long side (rallies) in the market than we would in a

secular bull market. As such a greater emphasis on the protective

attributes of our performance is appropriate as we judge or are judged

as to how we are doing."

During the 2007-2009

crisis, the stock market declined about 56%. During this period,

Charlie Dreifus, manager of the Royce Special Equity Fund, “kept” his

losses to 40.5%. For this, Morningstar declared him their

Domestic-Stock Manager of the Year in 2008. Apparently Morningstar and

the rest of Wall Street thought that was good performance. We think it

was horrible and the accolade disgraceful.

It is our belief

that when risk is elevated, great effort should be put forth to limit

losses entirely instead of aiming for a slightly smaller large loss

than the market (clients of JLFMI were down around 8.5% in 2008).

Hundreds of billions of dollars worth of investors didn’t think the

lack of attention to risk was so great either, by the way. They bolted

stocks and are still out, collecting 0.2% in money markets as a result.

Investors

may well be excused for crying uncle at the wrong time as they are

afflicted with the same malady as the rest of us -- human nature. The

goal they must seek to attain to become mature and realistic investors

is the realization that performance is both a function of mitigating

risk and attaining return that is appropriate for the conditions.

Expecting the maximum of both will require waiting for the second

coming, I am afraid.

Our approach has done particularly

well in identifying risky environments for the past 35 years plus. To

be honest, at times, the curse of human nature presses upon us a bit.

Until we can have all market moves completely under the control of a

computer, that may continue as much as we attempt to steel ourselves

against it. Meanwhile, we are confident that our goal of outperforming

the market over a complete cycle, with less risk, will be achieved.

Small Business in Caution Mode

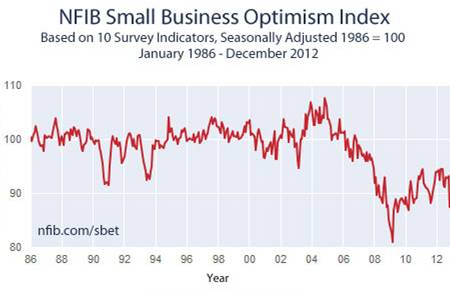

We are not alone in assuming a cautious stance. The nation’s small business owners are also far from optimistic as the following display indicates:

A scrutiny of the data makes it clear that the

presidential election was the primary cause of the recent decline in

owner optimism.

In the history of the monthly Index, only seven readings were lower, all but one in the last few months of 2008 and early 2009, the depths of the last recession. Prior to 1986 (when the survey was conducted on a quarterly basis), there were just two readings lower, 1975Q1 and 1980Q2.

Although, small business owners have the propensity to be the least optimistic at stock market bottoms, the fact remains that our economy is in substantially worse shape than it was at the corresponding time in the previous (1964-1982) secular bear market (see our September Newsletter).

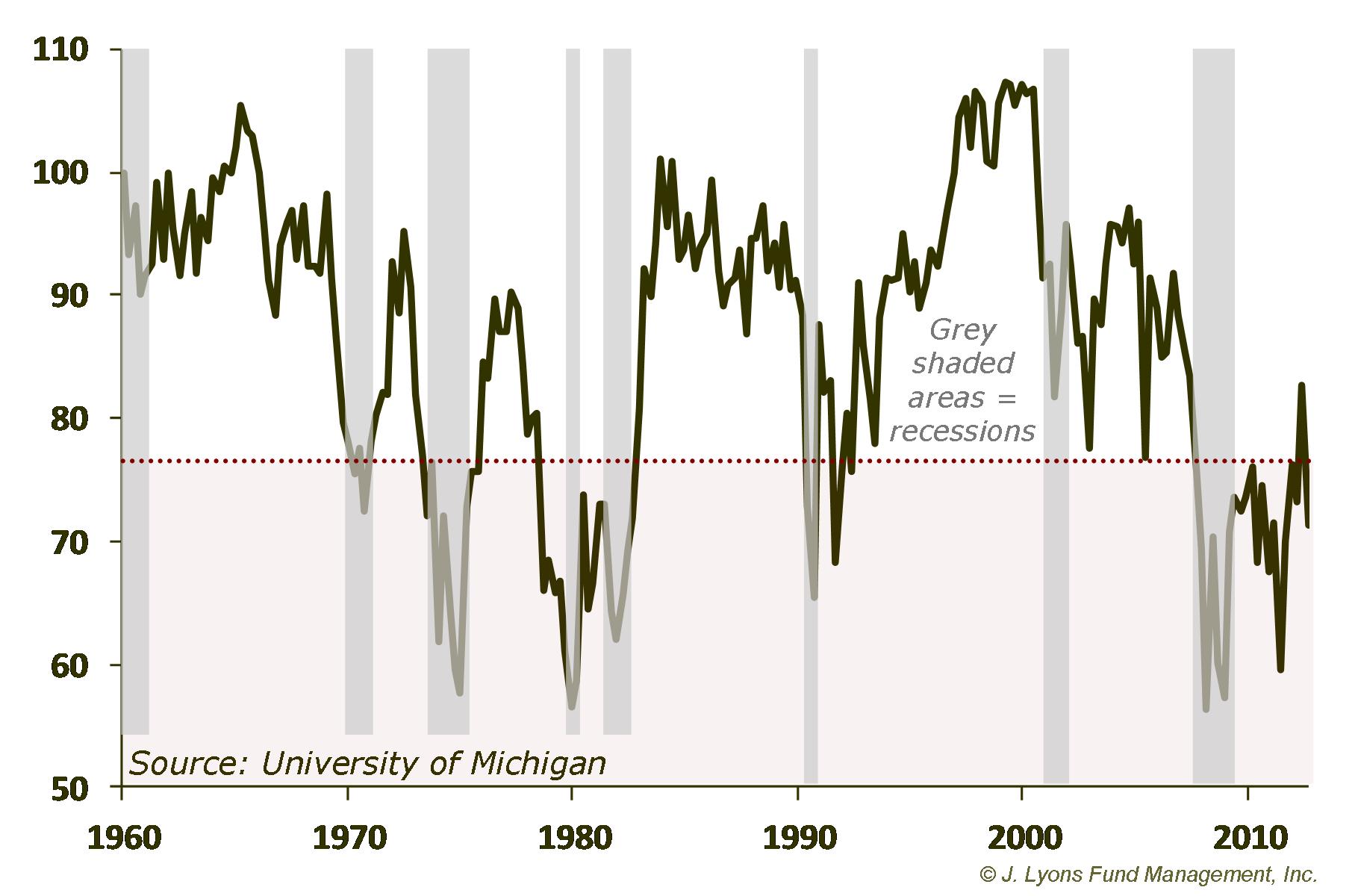

Consumer Sentiment Also Subdued

Like small business owners, consumers are equally unenthusiastic about the country's economic prospects, as evidenced by various consumer confidence readings, such as this one courtesy of the University of Michigan:

At

around 72, the current reading of UM Consumer Confidence is at an

extremely depressed level from a historical perspective. In fact, prior

to 2010, 97% of readings at or below that level had coincided with an

economy that was in a recession or was just entering or leaving a

recession. Consumer confidence this low is certainly not indicative of

an economy in a robust, or even moderately strong, expansion.

Furthermore, the duration of the ongoing bout of depressed consumer confidence is now unprecedented. Except for a temporary spike leading up to the 2012 presidential election (what a shock!), UM Consumer Confidence has been in the mid-70's or below for 5 years now. Even when the economy has undergone double-dip recessions, consumer confidence has not remained so low for so long. Clearly Main Street is not feeling the same "recovery" that is being promoted by various political, economic and media talking heads. And it is absolutely not experiencing an economic surge commensurate with a stock market at 5-year highs.

Why the Recent Stock Market Strength?

Good question and the reasons are many despite the fact that overall, it is tough to justify a market near its all-time high despite a languishing economy. However, as John Maynard Keynes was supposed to have said, “Markets can remain irrational a lot longer than you and I can remain solvent”.

One reason for the performance of the stock market is that with interest rates near zero, there are just not many alternative places to put one’s money. Moreover, with the Fed pouring unlimited funds into the economy and banks having tight lending strings, there is ample fuel to keep this market going, even if it is for the wrong reasons.

Finally another market rising catalyst is that many corporations, for whatever reason, are reporting very good profits. Part of this strong performance includes international exposure to areas of the world that are doing better.

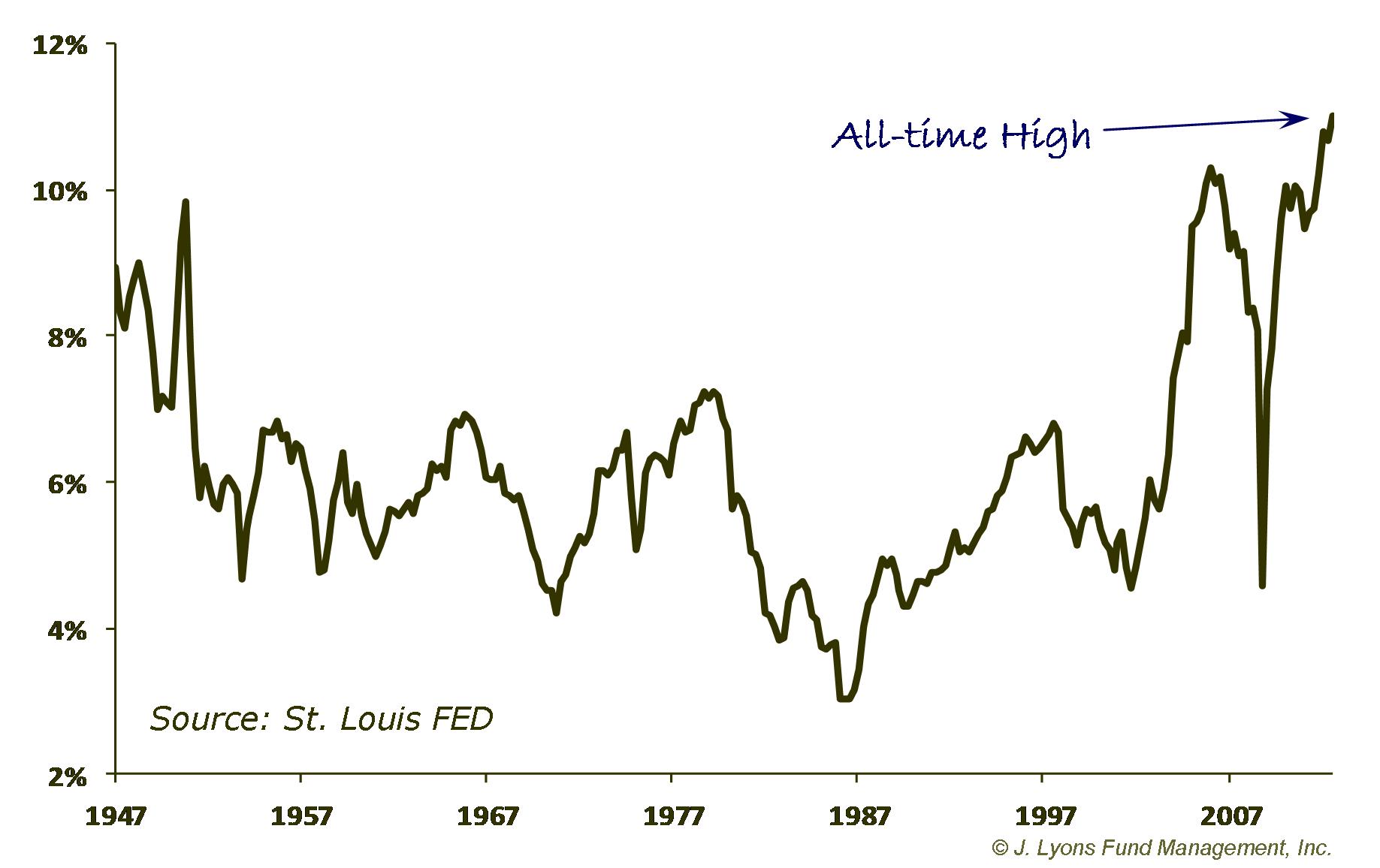

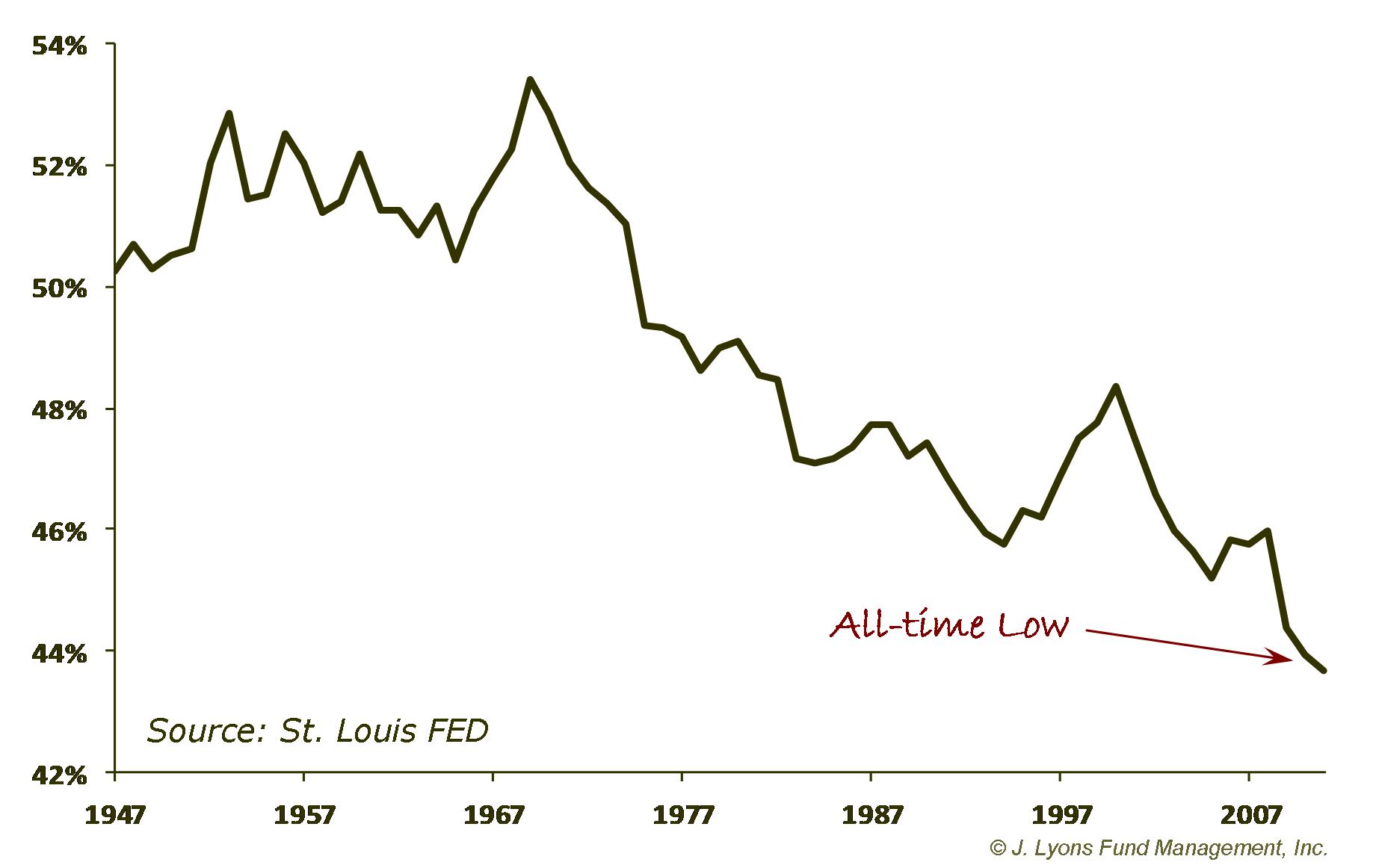

Part also is the fact that corporations are and have been squeezing every bit of productivity they can out of their work place. Associated with this latter point is the fact that wages and salaries have not kept up with corporate successes and in fact have gone the other way. This decline in wages and salaries is probably contributing to the increases in profits but is anything but a sign of a healthy economy. Nor does it bode well for a near-term, meaningful recovery as many out there are suffering from insufficient compensation. In fact, the middle class jobs are disappearing at an alarming rate from the economy.

The following charts are quite revealing and probably speak also to the number of uncounted unemployed people in our country.

Fortunately, despite the fact that both the current state of the economy and its foreseeable future are questionable at best, the state of the market does not always depend on a strong economy. In fact, somewhat paradoxically, historically there has often been an inverse correlation to overall economic growth and stock market performance. It would not be surprising to see a continuation of this market rally for a little while anyway. However, in the long run, as with all historical secular bear markets, the market is extremely unlikely to make any sustainable gains for several years to come.

Conclusion

As we quoted Albert Einstein in our last Newsletter, "the last thing to collapse is the surface." Indeed, a stock market that is making new highs for the past 5 years can mask a lot of sickness under the surface. Thus, in one regard, the Fed has succeeded in its Quantitative Easing campaign, insofar as it has aided in boosting asset prices. However, their ultimate objective of creating a sense of confidence through such rising asset prices is failing. From small business owners to consumers to middle class workers earning lower relative wages (not to mention paying higher taxes since December 31), most people are less than sanguine when it comes to their economic prospects.

Yes, it is "darkest before the dawn" and "you should be greedy when others are fearful". All of those kinds of market axioms regarding contrarian investing are valid. The problem is that the market is not depressed; only the people are. To us, the fact that the market is nearing its highs of its 12-year range in such a depressing environment suggests there is the real risk that we are facing a market out of touch with reality rather than a low-sentiment contrarian buy signal.

Of course, as per Mr. Keynes, the market can remain out of touch with reality indefinitely -- but not permanently. Eventually (usually after it has reeled in every Johnny-come-lately), reality sets in and the market reacquaints investors with the concept of risk. With the market nearing the top of the secular bear market range, we believe that time is approaching. And you thought people were unhappy now...

John S. Lyons

The

commentary

included in this newsletter is provided for informational purposes

only. It does not constitute a recommendation to invest in any

specific investment product or service. Proper due diligence should be

performed before

investing in any investment vehicle. There is a risk of loss involved

in

all investments.

| Tweet |

|