Investment Philosophy

"The ultimate quest in investing should be to outperform the overall market over a complete market cycle -- with less risk."

Active Management: Managed-Risk Investing for the Real World

At J. Lyons Fund Management, Inc., our goal is simple: generate long-term, market-beating investment returns for our clients while protecting them from any large losses. To accomplish our goal, we utilize an investment approach referred to as "active management". This does not mean we are constantly moving in and out of the market or constantly shifting investments within our portfolio. Rather, active management means we employ a more "active" approach in reducing our clients' investment risk as opposed to the "buy-and-hold" approach espoused by the Wall Street "establishment" and most investment advisors and financial planners.

Unlike the buy-and-hold crowd, we do not feel it is inevitable to suffer large, periodic losses in the stock market. In fact, it is the ability to avoid large losses that provides investors with the best chance to achieve long-term investment success. The only way to accomplish that is to utilize an investment approach that includes both a buy strategy to enable growth and a sell strategy to control risk.

It's not necessary, nor do we attempt, to catch every little move in the stock market. We simply strive to have our clients assets invested during the greater part of significant market advances, and to avoid (or at times, even profit from) the greater portion of significant declines. This approach can provide for more consistent returns that are less dependent on the existence of a bull market to succeed. This is an especially good thing considering the recent difficult market environment for investing that unfortunately is likely to persist for several more years. As a result, we feel strongly that not only is the J. Lyons Fund Management, Inc. approach the optimum investing alternative for most individuals, but it also may be one of the few possibilities that really makes sense over the long term.

Read more

about the Active Management philosophy and why it is so critical to

investment success in our report below, "A Battle for Investment

Survival".

A Battle for Investment Survival

The JLFMI investment approach combats the deficiencies of "traditional" investment methods and myths and counters the harmful forces of human nature.

For most investors, professionals included, achieving successful investment performance with consistency is a very difficult task. Those with experience in various investment markets know this reality all too well, while the vast majority of individuals with less experience probably have the same sobering lesson in front of them. In our years in the investment business, we have observed certain fundamental and almost universal investing problems. Specifically, few individuals have the resources or the time available to enable them to undertake a well-conceived investment program. Fewer still, even those with a real aptitude for investing, have the hardened discipline that is an absolute prerequisite for it. To make matters worse, much of the advice directed at investors contains investment myths that ultimately end up being more harmful than helpful.

The Myth of "Buy-and-Hold"

The most often repeated and probably most egregious of the investment myths is the idea of "buy-and-hold". The buy-and -hold approach rests upon the conviction that the stock market moves only upward over time. Proponents of that philosophy state that one cannot determine the level of risk in the stock market at any given time and, therefore, it is best not even to try. Their default advice to investors is to simply rely on that long-term direction.

First off, investors should be aware of the various ulterior motives of the proponents of buy-and-hold. It's not to say that these motives are necessarily devious, just that they are not necessarily in the best interest of the investor. For one, many managers or advisors are compensated only if the investor's money remains in the fund or investment they put it in. Therefore, the advisor has an obvious interest in keeping or advising the investor to keep the money in that particular investment, regardless of its performance.

Another motive behind the promotion of buy-and-hold is quite simply that it is easy. It takes very little effort to implement the strategy since, as the name implies, after the "buying" is done, all that's left is the "holding". And again, holding an investment no matter what it does is not necessarily what's in the best interest of the investor. It may be forgivable for an amateur to adopt such a strategy as they cannot be expected to find the time and expertise needed to effectively perform such a complicated task as investing. However, for an advisor, manager or broker to follow buy-and-hold with their paying client's assets simply because it is easy is intolerable, not to mention it does not serve the client well. Investors deserve much better than that from their advisor particularly since, by definition, it is a guarantee that on a regular basis that investment approach cannot be the best interest of investors. The deficiencies of buy-and-hold are simply too obvious and damaging for that to be the case.

The buy-and-hold approach, again, is predicated on the theory that the stock market moves only upward over time. There are distinct fallacies with that approach to which anyone invested in the stock market during the tech stock implosion of the early 2000's or the subsequent subprime, credit crunch induced bear market can attest. The fact is, bear markets are a reality, and not an uncommon one. Historically, bear markets occur every five years, lose an average of 38% and take an average of three and a half years to recoup the losses.

Buy-and-hold proponents will argue that these are simply short-term market fluctuations. However, short-term or not, losing 50% of one's assets is not an insignificant event that can easily be dismissed, particularly for someone nearing retirement who is going to be dependent upon that money. And the notion that such a painful loss is not the fault of the investment strategy but simply an unavoidable result of the market declining is little solace to the person taking the loss.

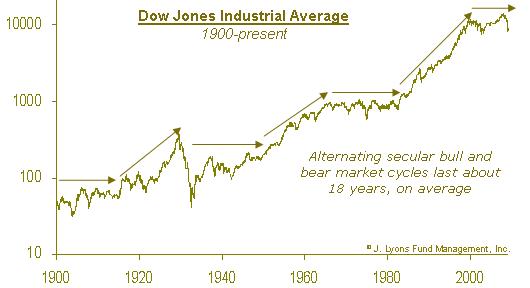

At times it is true that, if investors could but "wait it out", they may come through unscathed. However, there have historically been numerous, extended periods, which we refer to as "secular" bear markets, when the stock market has gone sideways to downwards over a period of many years. Furthermore, not only have these secular bear markets occurred in the past, but as shown in the chart below, they are a regular event in the repeating market cycle.

The 1929 high in the Dow Jones was not exceeded until 1954 and the 1966 top was not surpassed until the summer of 1982. And most relevant now, the Nasdaq Composite, which topped out at over 5000 in the year 2000, was still more than 50% below that mark nearly a decade later. For those investors without the luxury of a 40, or even 20-year investing horizon, sometimes waiting to recover serious losses is not an option. Even with a longer time horizon, the psychological damage and loss of objectivity suffered by an investor often distorts future investment decisions, as we discuss below.

Human Nature is the Bane of Most Investors...and their Advisors

After taking all of its deficiencies into account, if an investor still chose the buy-and-hold approach, it is unrealistic to expect that he or she would even be able to implement it in a disciplined manner. That's because without an objective program like JLFMI's, it is difficult for investors and advisors alike to avoid the ill effects of human nature. The consistent forces of human nature cause us to react to circumstances in a similar and predictable fashion. Unfortunately, when it comes to investing, these human natural reactions more often than not illicit the wrong response.

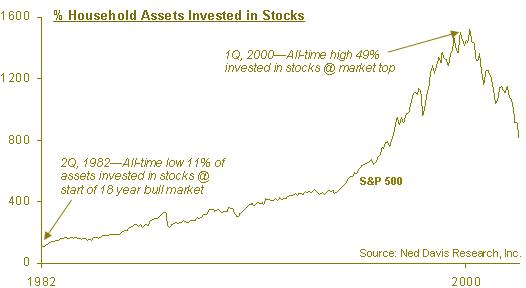

The two most influential human natural traits that most often lead investors astray are fear and greed. Yet, as easy as it is to be aware of these influences, it is equally difficult to avoid them. That is why at junctures of buying opportunity in the stock market, people are too frightened and too focused on potential risk to be totally objective. Conversely at market tops, the lure of yet higher highs and of missing out on more profits clouds the perspective of investors. The following charts illustrate this point.

Due to fear of a stock market that had gone sideways since 1966, households had an all-time low of 11% of their assets invested in stocks during the 2nd quarter of 1982, just as the stock market embarked on an 18-year bull market. Conversely, greed consumed households in the 1st quarter of 2000 as they had an all-time high 49% of their assets invested in stocks, right at the onset of the current bear market. This means that investors failed to capture much of the gains of the 1980s-90s bull market and incurred much of the loss associated with the bear market since 2000.

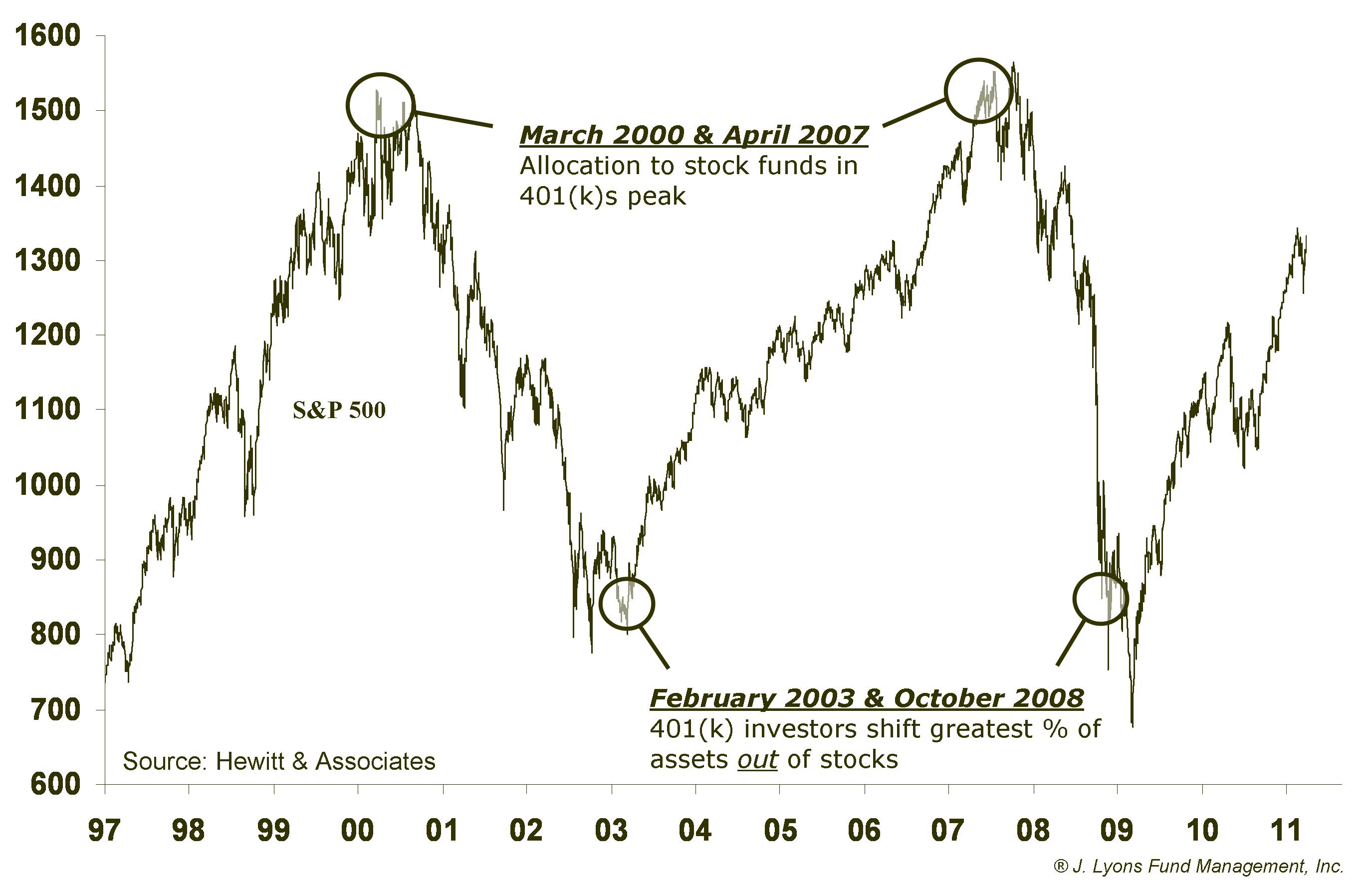

A similar pattern is seen in a study by Hewitt & Associates into the investment behavior of 401(k) participants. According to their survey, 401(k) investors' allocation to stock funds peaked in March of 2000 and April of 2007, right near the market peaks. On the flip side, participants pulled the greatest amount of money out of stock funds in February 2003 and October 2008, right near bottoms.

These reactions are natural. First of all, we are greatly influenced by the environment of our recent past. Secondly, at these junctures our hopes and fears are constantly being reinforced by what we are reading, hearing and observing. In other words, the pressures on investors at both significant market tops and bottoms are the greatest to take what eventually will prove to be the wrong course of action.

Other "Traditional" Investment Methods Fall Short

Over the years, other various "traditional" investment strategies have been used in attempt to overcome the challenge of investing and counter the forces of human nature. These methods have had decidedly mixed results and, when it comes down to real world investing, like buy-and-hold, they are arguably more myth than they are reliable.

MYTH #1: Seeking "Conservative" Investments

Many frustrated investors, for example, decide to become "conservative". But just what is a conservative investment approach? Investors who sought the protection of many so-called "conservative" investments have not always gotten what they bargained for to the detriment or, at times, devastation, of their investments.

- Highly rated bonds (or bond funds) have shocked investors at times as their investments declined as much as 30% in recent years (1994, 1999 and 2008, for example).

- Once hallowed blue chip stocks like Continental Illinois Bank, Enron, General Motors, AIG and others were once labeled "prudent man" investments. Hindsight has obviously told another story, revealing how these companies resulted in extinction, or perilously close to it.

- Target-date retirement or lifecycle funds have become popular in recent years as they shift their asset allocation for investors to (supposedly) become more "conservative" as they approach retirement age. Investors in such funds earmarked for 2005 retirees would likely challenge the effectiveness of the conservative shift as they lost as much as 30% of their value from 2007 to 2008.

- Investors who purchased AAA-rated CDOs and other similar instruments in recent years were lucky to get back pennies on the dollar for their investments as the sub-prime housing market underlying the instruments collapsed, almost bringing down the entire financial system as we know it.

While it's true that these horror stories don't always represent the behavior of these "conservative" investments, the fact is that these events do occur and will occur again repeatedly in the future. Regardless of the normal behavior of the investments, failing to account for the possibility of such damaging losses can be devastating to a portfolio, particularly for an investor nearing retirement age. And it only takes one such "abnormal" event to bring devastation.

MYTH #2: Diversification

More

recently, asset allocation and diversification become the "buzz words"

as

approaches to controlling risk. The idea behind these popular

techniques is

that spreading investments across all market segments will bring more

consistent returns and reduce risk on the theory that the

declining segments will be offset by rising ones. Unfortunately, we

have found that all diversification ends up doing is diluting returns

in up markets and providing too little risk protection in down markets.

Witness the losses in a broad array of market segments in 2008 --

diversification sure didn't do much to reduce risk:

| Index | Loss

from 2007 High |

| Dow Jones Industrials | -42% |

| S&P 500 | -46% |

| Nasdaq | -48% |

| Large Cap Growth | -47% |

| Large Cap Value | -60% |

| Mid Cap Growth | -45% |

| Mid Cap Value | -56% |

| Small Cap Growth | -47% |

| Small Cap Value | -59% |

| Dow Jones Utilities | -41% |

| Gold/Silver Index | -69% |

| Japan | -61% |

| Europe | -49% |

| Emerging Markets | -65% |

The problem with these so-called "traditional" investment methods is that they fail to account for the existence of bear markets and thus do not address the most important question: Should one be invested at all?

The JLFMI Investment Approach Addresses this Problem

J. Lyons Fund Management, Inc. has a different philosophy regarding what it takes to reduce risk. We feel that it is not what you invest in that necessarily renders an approach conservative, unless you want to settle for treasury bill rates. Only the use of adequate controls on when you invest in whatever you invest in can reduce your investment risk to a conservative level. Around this concept is built our investment strategy. Fundamentally, our investment philosophy focuses on two observable truths:

- Some of the best investment returns have historically come from equity investments.

- There are times to be in equities and times to be out -- completely out.

A quick glance at a chart of a major stock market index will confirm this. Look at the chart of the S&P 500 once again, for example.

From 1996 to 2000, the S&P 500 about doubled in value. However, by 2002, it had lost the entire gain. The next six years saw the index repeat the same cycle again. Being out of the market for even a portion of those declines would have considerably enhanced the returns referred to in #1 above.

The JLFMI Risk Management System

Well-accepted studies have shown that some 75% of the reason that a stock (or stock fund) moves up or down can be attributed to the direction of the overall market. Because of that fact, and because the guidance from Wall Street firms regarding what stocks to buy and sell has been so ineffective, we long ago decided to concentrate our efforts in determining which direction the overall market was moving, and likely to move. Or put another way, what is the level of risk present in the market?

Our objective, naturally, is to invest more aggressively when risk is low, i.e., the overall market is moving up. Conversely, when market risk is high, our focus is on preserving capital, i.e., reducing exposure to the market. By employing this approach, we aim to lower the potential risk of investing while still capturing the growth of capital necessary for a retirement plan, or any type of investment account for that matter.

The JLFMI Risk Model

Central in our strategy to identify risk is the JLFMI stock market Risk Model. It was developed in the mid-1970's and has been in use now since 1978. The Risk Model consists of various proprietary individual indicators comprised of data inputs taken directly from the stock market. These indicators represent different measures of market strength, with a focus on breadth (how many stocks are rising versus falling) and momentum of breadth (how strongly is the breath improving or worsening). Collectively, these indicators quantify the strength and, by extension, risk of the overall market and orient our investment posture for the forthcoming period.

The Risk Model was devised and refined over many years encompassing both bull and bear market cycles, and indeed, was designed to function in all types of market environments. As a result, the Model has helped us to successfully navigate the stock market over the course of the past 30 years, through the roaring bull market of the 1980s and 90s and the subsequent decade-long (to date) secular bear market. We are confident that it will be as relevant for future markets as it has been for those of the past.

One of the salient features of the Risk Model is the objectivity that it lends to our decision-making. There is only a minimal amount of interpretation involved in arriving at our buy and sell signals. That objectivity aids us in combating those harmful forces of human nature by allowing us to largely avoid emotionally charged situations which can often induce incorrect investment moves.

Is the Risk Model pinpoint accurate? No, certainly not. The Model will be a bit late at times in signaling turns in the market and early at others. However, pinpoint accuracy is not required to produce exceptional rates of return. The ability to be correctly positioned for most of the significant trends in the stock market and to avoid large losses is what is necessary. And since the components of the Risk Model are direct measurements of what the overall market is actually doing, by definition it cannot stay out of sync with the market for long. Therefore, we are confident that it will continue to aid in keeping us correctly positioned for the major moves in the market. Furthermore, most investment alternatives, like buy-and-hold, have serious and obvious deficiencies in declining markets, exposing one to damaging losses. Those deficiencies are potentially much more harmful and more difficult to overcome.

Summary

The J. Lyons Fund Management, Inc. investment approach aims to take advantage of the attractive returns historically available in equity markets while reducing the risk of incurring substantial losses during declining markets. Thus, our Active Management strategy has allowed us to meet our objective: to outperform the market over a complete bull and bear market cycle -- with substantially less risk. And versus other investment approaches that we have scrutinized not only do we believe our to be conceptually much sounder for “all seasons” but it may be the only approach that stands a chance to succeed in the secular bear market environment that is likely to persist for the better part of the next decade.

Our

success in

developing and utilizing our investment techniques has depended upon

objectivity and thoughtful planning. Your success in deploying your

investable funds will depend upon the same factors. We are very willing

to discuss our services at length with you so that you will be better

prepared to make the correct decision when considering the great number

of investment alternatives available to you. Please feel welcomed to contact us to begin a

discussion.