J. Lyons Fund Management, Inc. Newsletter

| February/March 2016 |

Posted March 4, 2016 |

| Tweet |

|

|

Breaking Bad

Anatomy Of A Market Top - Part 2

The last and most important bastion of the cyclical bull market in U.S. stocks -- price -- has finally broken down.

“Once

the relatively few leaders propping up the market begin to

collapse...the inevitable

cyclical decline can commence. That is when

Part 2 occurs: breakdown of prices.

This looks to be unfolding as we speak, so stay tuned…”

- Conclusion from August 2015's ‘Internal

Combustion, Anatomy Of A Market Top - Part 1’

For some time now, we have been detailing a steadily expanding litany of concerns regarding the longer-term prospects of the U.S. stock market. These concerns have generally revolved around ancillary factors relative to stock prices. Such factors include metrics pertaining to valuation, sentiment, investor allocation, investment leverage, corporate profligacy and so on. These are what we call background indicators, as opposed to actionable signals. They represent big-picture market conditions from which longer-term stock market expectations can most reasonably be formed.

One might think of these background conditions as measures of the market's prevailing potential risk. And based on recent readings, the potential risk as expressed through these background indicators could hardly be greater. As such, they currently signify circumstances from which stocks have historically experienced subpar longer-term returns. Furthermore, on a secular basis, these background indicators typically cycle from extreme excess at a secular market top (e.g., 2000) to extremely depressed at a secular low. Intensifying the current longer-term risk is the fact that these indicators never fully corrected their secular excesses during the post-2000 bear market.

That background synopsis represents the informal, unwritten first part of our ‘Anatomy Of A Market Top’ series -- call it Part Zero, if you will. Probably the closest piece to a formal discussion on this topic is our May 2014 Newsletter (in Part 1, we incorrectly suggested it was the October 2013 edition). In the August 2015 Newsletter, we issued the formal Part 1 of the ‘Anatomy Of A Market Top’ series, titled “Internal Combustion”. In it, we detailed the systematic deterioration in the internals of the stock market that had been developing for the better part of 2015. At the time, this trend had begun to reach depths historically seen only near major market tops. And yet, the major stock averages continued to persist near all-time highs.

There remained just one missing ingredient in transposing the potential risk posed by the background landscape and internal deterioration into manifested risk: a break in prices. And for all of the ominous looking conditions represented by the aforementioned factors, the single factor most vital in supporting the persistence of the bull market had continued to be constructive. That is price. Price is the one thing that has the ability to trump all of the ancillary concerns that we have laid out. And over the past several years it has, vaulting the bull market to levels that were, by some measures, unprecedented in history.

Stock market bulls -- both the reasonable as well as the "perma" species -- pointed to this resiliency in price as evidence to support their market stance. And while many bulls stubbornly refused to acknowledge the gathering risks indicated by both the background conditions and the internal deterioration, they were correct about price -- at least as it pertained to the major cap-weighted averages. Unfortunately for investors, that appears to have changed. This last, most crucial support piece of the bull market has finally given way as prices are breaking bad. As we illustrate in this piece, Part 2 has arrived.

Disclaimer: While this study is a useful exercise, JLFMI's actual investment decisions are based on our proprietary models. Therefore, the conclusions based on the study in this newsletter may or may not be consistent with JLFMI's actual investment posture at any given time. Additionally, the commentary here should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies.

Like most market analysis, a price "breakdown" is a subjective thing. Therefore, in an effort to lay out our breakdown case in the most broadly receivable way, we present the following charts in a basic, almost Neanderthal manner. Per Einstein and Occam's razor, simpler is better anyway, right? So, what are the most elementary determinants of a break in a price uptrend? How about a break of an up-sloping trendline and a series of lower highs and lower lows? That's about as basic and uncontroversial as it gets. It's so clear, a caveman can see it. If perma-bulls cannot recognize the blow that prices have been dealt over the past few months by viewing the following charts, there may be no getting through to them.

Below is but a sampling of key equity indices that have suffered potentially fatal bull market blows, based (mostly) on the aforementioned primitive standards. These may not all be the most popular of indices, but they were chosen because, in our view, they best represent the true trend of the equity market. (Some of the charts are as much as a month old and have seen prices recover some; however, the damage has already been done, in our view.)

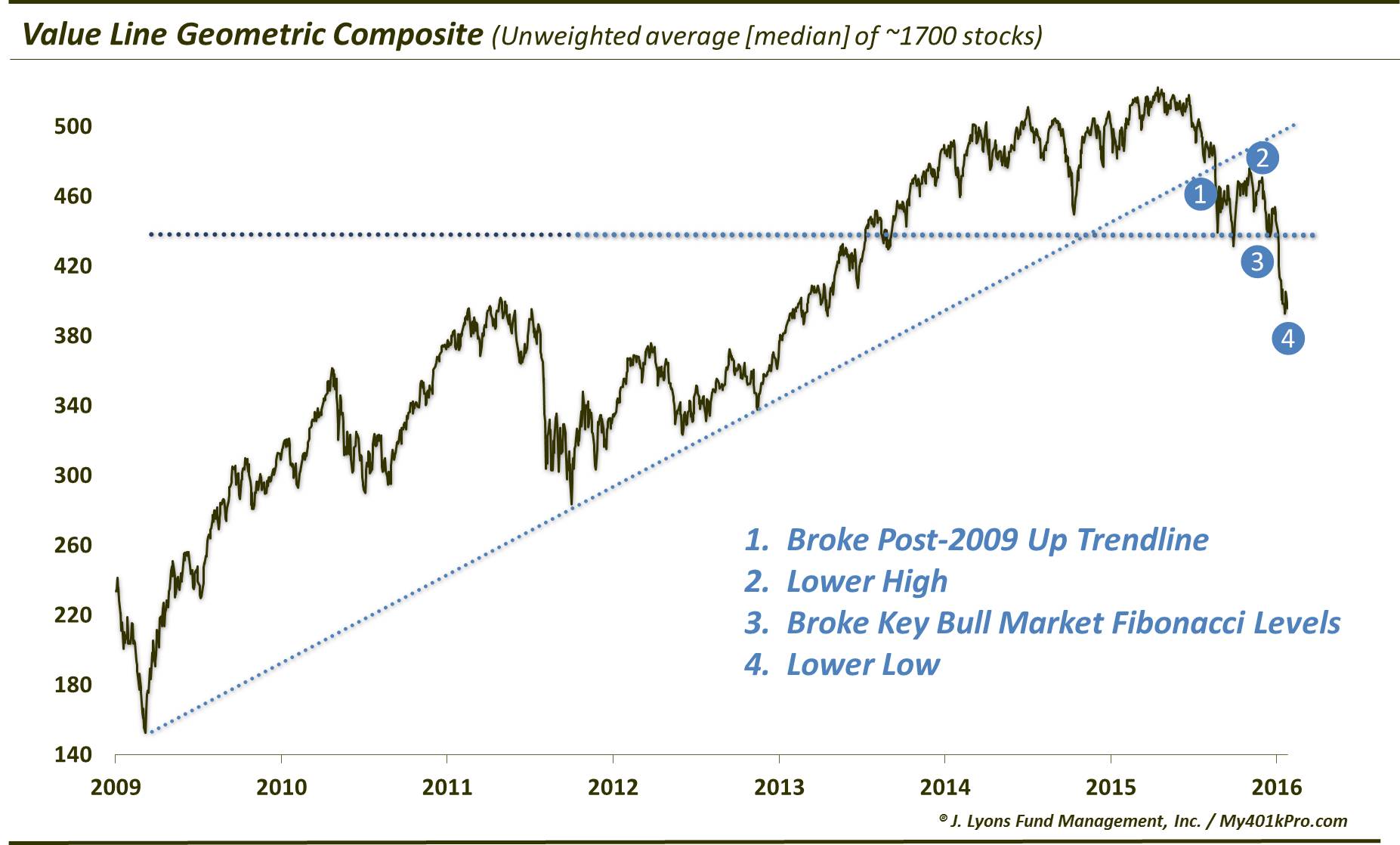

Value Line Geometric Composite

The Value Line Geometric Composite is an unweighted index of approximately 1700 stocks that essentially measures the median stock performance among the universe. As such, it is our favored index in instructing us as to the true health of the U.S. equity market. And based on recent events, the market's longer-term health has taken a turn for the worse.

As the chart shows, the action over the past few months has resulted in the following breaking developments in the Value Line Geometric Composite:

1) It broke its

post-2009 Up trendline

2) It has formed a lower high

3) It broke key Fibonacci Retracement lines pertaining to the post-2009

bull market

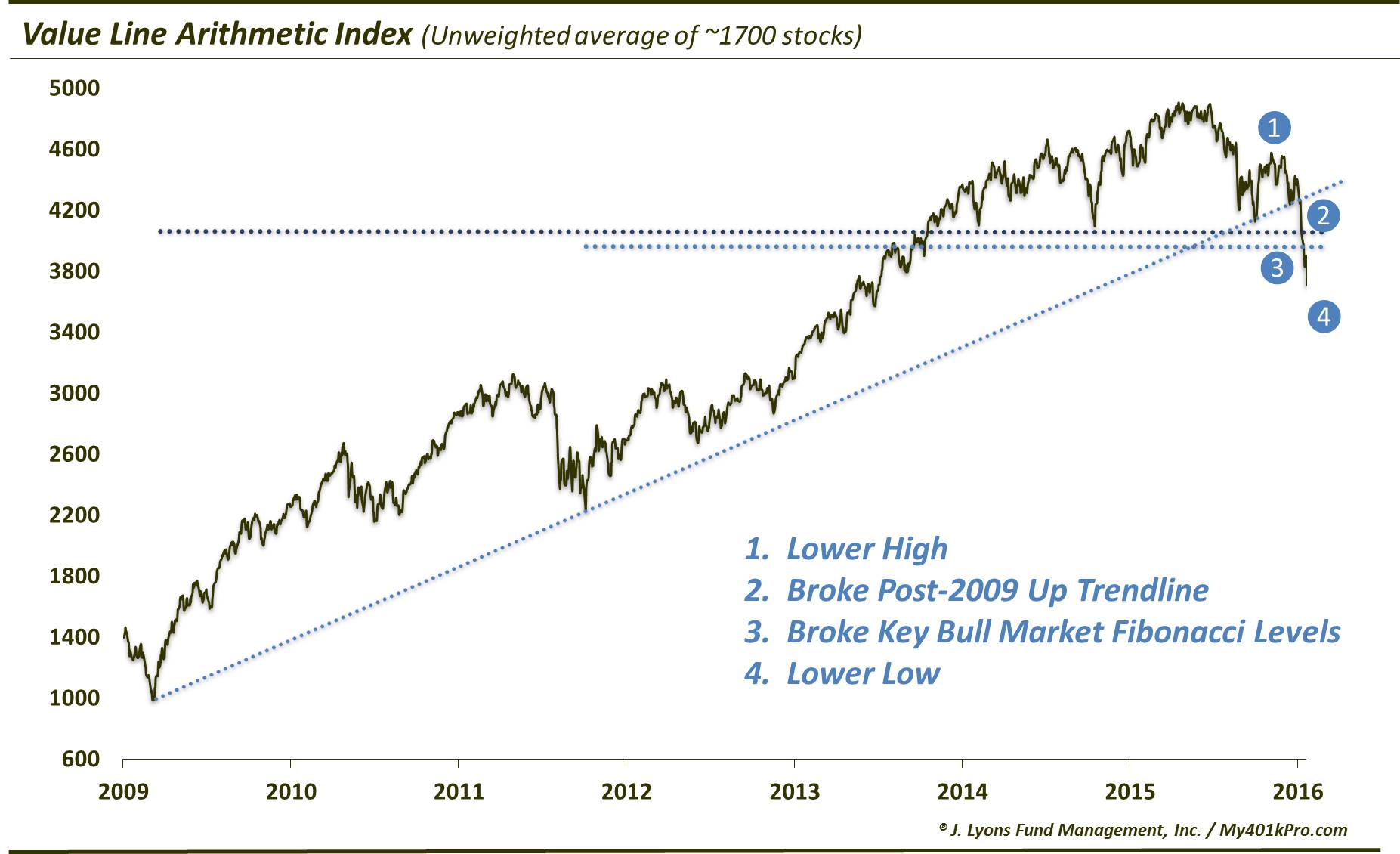

Value Line Arithmetic Index

Similar to its Geometric sister, the Value Line Arithmetic Index essentially measures the average stock performance among the equally-weighted 1700 stocks. Also similar is the fact that its uptrend has broken.

NYSE Composite

Another of the broadest stock market gauges, encompassing some 2000 securities, is the NYSE Composite. Like the Value Line Indices, the NYSE's uptrend has broken down based on the same basic criteria.

Russell 2000

Similarly, one of the broader, high-beta areas of the market has also broken down: small-caps. These stocks typically represent the “risk-on/risk-off” situation in the market. And judging by the Russell 2000, the environment has definitely switched to risk-off.

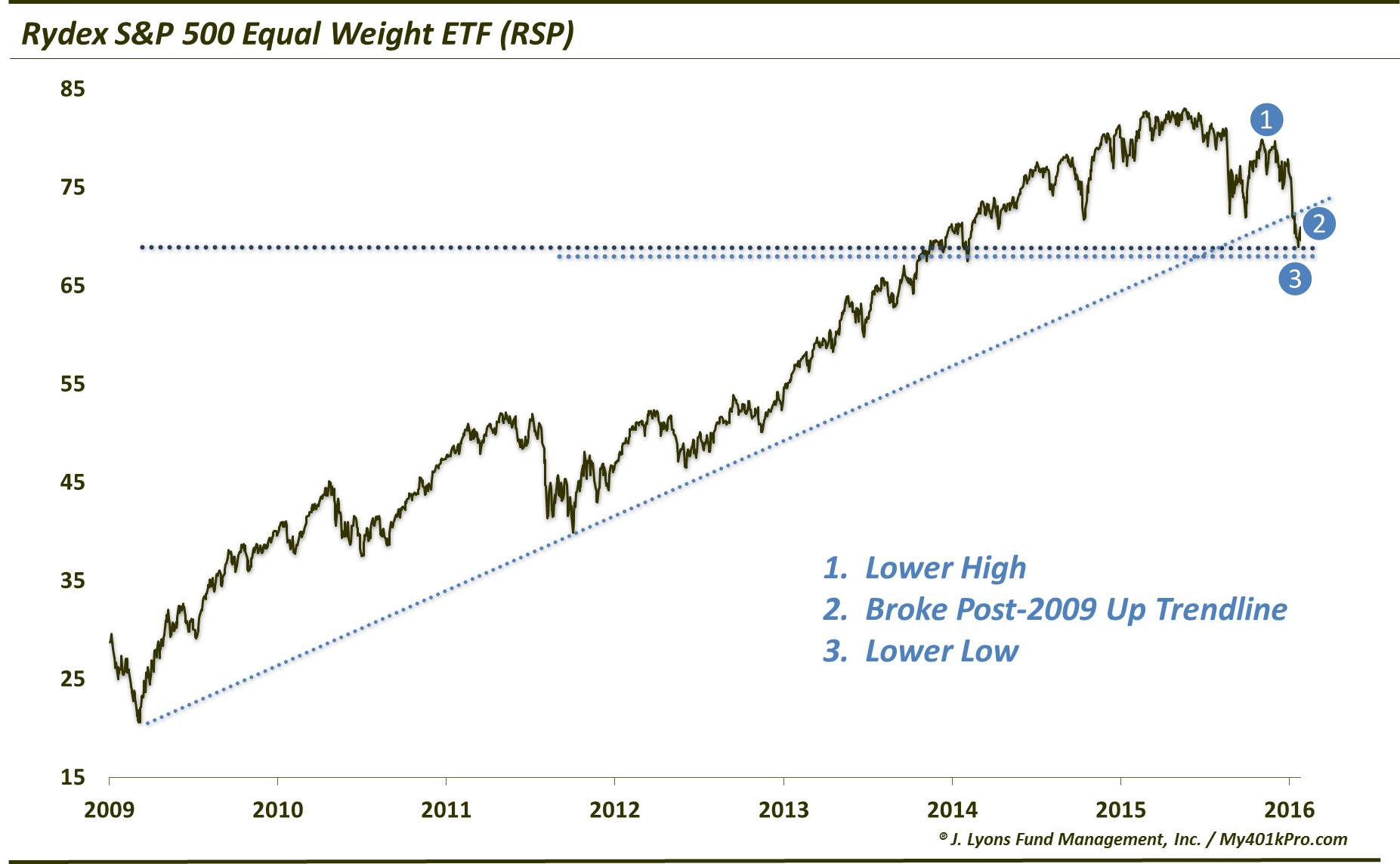

S&P 500 Equal-Weight Index

It is not just the laggards that broke their uptrends

either. The large-cap space, which had held up the best (albeit on the

back of a

thinning number of mega-cap stocks), has also succumbed to breaking

prices -- if you measure it correctly. Witness the action in the

equal-weight S&P 500 ETF (ticker, RSP).

The Global Dow

Our focus here is mostly on the U.S. equity market and cycle. However, the financial world is increasingly flat and when one market breaks, the cracks tend to extend to other markets as well. Thus, in addition to the U.S. indices breaking bad, global and international markets have also exhibited similar characteristics of markets that have topped out. One example is the Global Dow Index, which is an unweighted average of 150 of the largest stocks in the world.

MSCI EAFE Index

Perhaps the most widely watched international composite is the MSCI EAFE Index of developed markets. Here too, one can easily see the hallmarks of a broken uptrend.

.

.

MSCI All Country World Index

It is the same story with one of the broadest global equity indices, the MSCI ACWI. The ACWI includes 46 country equity markets from around the globe. Judging by this index, the global equity bull market has most certainly been broken.

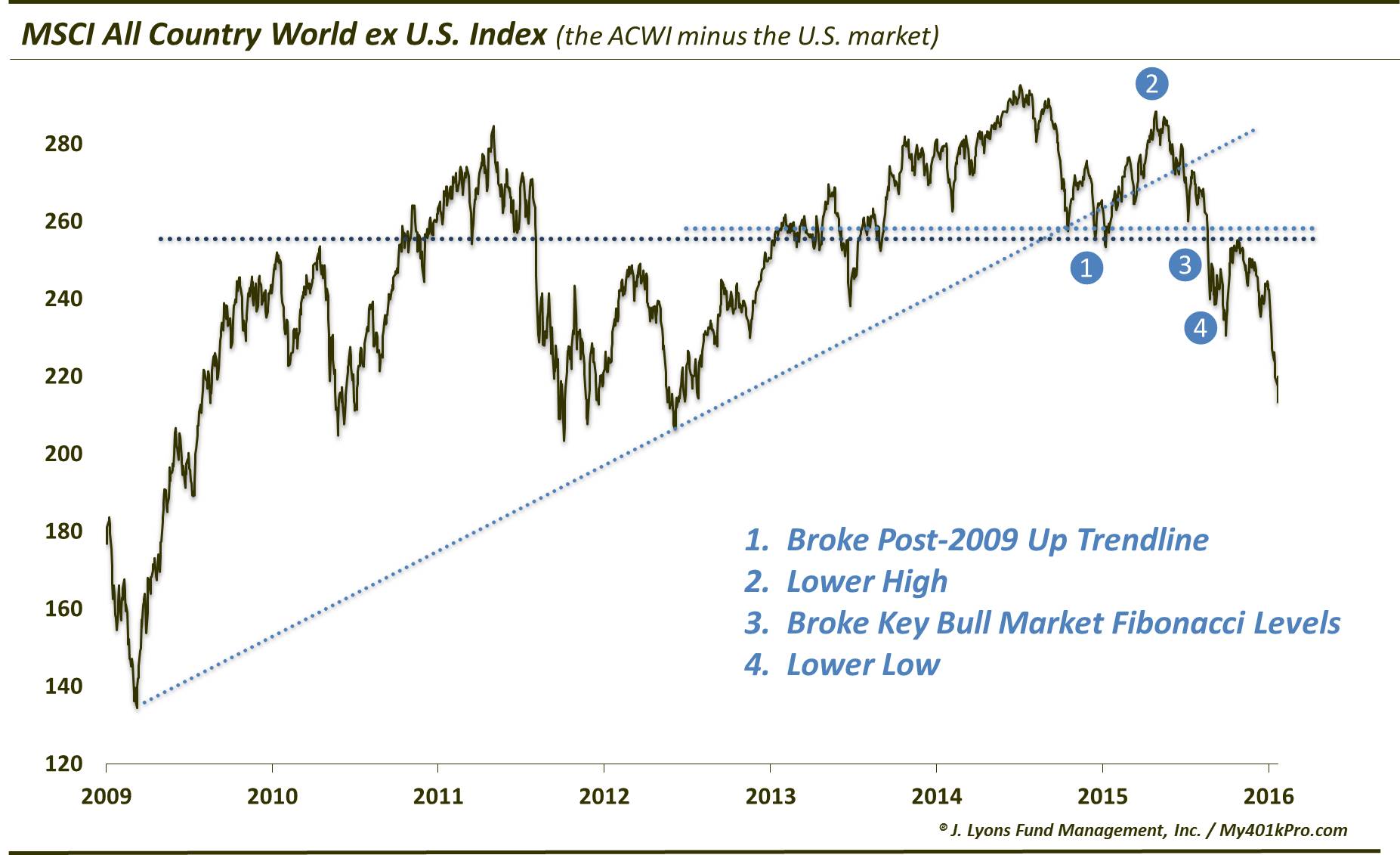

MSCI All Country World Index ex U.S.

As most investors probably know, the U.S. equity market was one of the last world markets to succumb to the recent selling pressure. Thus, the brokenness of the ACWI chart above has little to do with U.S. stocks. Lest anyone think any differently, take a peek at the MSCI All Country World ex U.S. Index. It is exactly what the name implies: the 45 countries in the ACWI besides the U.S. This one has been broken for a while now.

We could certainly show many more examples of indices whose post-2009 cyclical uptrends have clearly and decisively been broken. However, that would be redundant. We have selected what we feel are the most instructive indices in revealing the true trend of the broad market. We're not talking about the Sri Lankan Stock Market here, or the Dow Jones U.S. Waste & Disposal Services Index. We're talking about the broadest, most important indices in the U.S. and the world. And unanimously, the message is that the uptrend is over.

What Does This Mean?

Before jumping to conclusions, let's discuss what these broken markets mean. Let's again keep things simple: it means that the post-2009 cyclical bull market for most stocks has likely topped. The broad uptrend has been clearly broken and, therefore, one should not be investing, or trading, under the assumption that the bull market is still intact. Importantly, that means do not expect the series of higher lows and higher highs -- with unlimited upside -- to be the case for the foreseeable future.

What Does This NOT Mean?

Just as importantly, what does this broken uptrend not mean to markets? First off, it does not necessarily mean that a severe bear market must follow, either in time or price depreciation. The period subsequent to this cyclical market top will semantically be referred to (by some) as a cyclical bear market. However, that can take many forms.

The market may indeed suffer a prolonged bear market, delivering substantial losses to investors, ala 2000-2002 and 2007-2009. On the other hand, it may also be merely a period of digestion or consolidation during which the market takes a "breather" from its bull run, but suffers relatively little in the way of losses. Additionally, even if a major bear market is in the offing, it will not be a one-way, straight shot to the floor. There will be starts and stops along the way, with a fair share of sharp rallies, such as the ripper currently underway. Furthermore, it is certainly not implausible to think that some of the leading indices may yet make new highs as the market transition evolves.

The main point is that identifying a market top is different than forecasting a severe bear market.

What Do We Think This Means?

Our comprehensive research suggests there is great risk of a severe bear market. First, the extent of the deterioration in market internals that we documented last year have, without exception, led to extensive cyclical bear markets. Yes, the breadth divergences can persist for a while, but once prices break, there has been no more putting off the inevitable. And prices have broken as we demonstrated. Probably the closest comparisons to the internal damage that we witnessed last year preceded the cyclical market tops in 1973 and 2000. Each preceded 50% declines in the S&P 500.

Perhaps even more concerning is the situation surrounding the background indicators mentioned in the introduction. These factors, such as price:long-term trend, valuation and household stock allocation never fully worked off the excesses that were built up into the 2000 secular top. Furthermore, these types of metrics have always cycled to the opposite extreme prior to the launch of the next sustainable secular bull market. Not only have these background indicators not fully worked off their secular bull market excesses, but they are now back closer to excessive extremes -- with some measures even exceeding prior cyclical peaks.

In order for these indicators to truly work off their excessive readings, not to mention move them to extreme levels to the downside (where we expect them to eventually end up) it will likely take substantial market losses or a substantial amount of time without positive returns -- or likely both.

Conclusion

When 2015 began, the potential risk of a developing cyclical top in the stock market was considerable, based on longer-term background metrics such as valuation, sentiment, investor allocation, etc. However, stock market bulls pointed to the indices which continued to move higher in spite of the risk. 6 months later, an almost unprecedented deterioration in the internals had left the market foundation weaker still and the prospects of a market top even greater. Still, bulls pointed to the strength in the large-cap, weighted indices which remained the last buoyant holdouts on the backs of a few mega-cap stocks.

Finally, beginning shortly after that in August, the final bastion of the bull market began to fall: prices. And the escalation of the decline to begin 2016 left little doubt, based on the most basic of trend analyses that we have highlighted here, that the market's cyclical uptrend had been broken. No, this does not guarantee that a severe bear market will necessarily unfold, though we think it will. The point is that the post-2009 bull market is, in all likelihood, over.

Perma-bulls are fond of saying price is truth. We agree. But if they cannot acknowledge the clear and decisive breakdown in stock prices now, perhaps they simply cannot handle the truth.

Dana Lyons

Partner

The

commentary

included in this newsletter is provided for informational purposes

only. It does not constitute a recommendation to invest in any

specific investment product or service. Proper due diligence should be

performed before

investing in any investment vehicle. There is a risk of loss involved

in

all investments.

| Tweet |

|

|