J. Lyons Fund Management, Inc. Newsletter

| April/May 2014 |

Posted April 21, 2014 |

| Tweet |

|

|

2014 Secular, Ahem, Bear Market Update

Despite new market highs, evidence still suggests that the post-2000 secular bear market is not over.

“For every action, there is an

equal and opposite reaction.”

- Newton’s Third Law of

Motion

It is once again time for our annual status report on the post-2000 secular bear market. We have published many such updates since 2000 (informally in our Quarterly Client Letters since identifying the secular bear in 2001 and formally in this space for the last half decade). However, this is the first one published with several of the major stock averages currently trading above the previous secular bear market range -- thus, the sheepish title. So, is this the update when we finally declare the bear dead? For those hoping for the “all clear” sign, unfortunately the answer is no. While the extent of the new highs in the stock market is atypical for a secular bear market -- and not what we expected to see -- it is not necessarily a death-knell for the bear. In fact, the preponderance of evidence, per Sir Isaac, suggests the bear is merely hibernating.

So what makes the cautionary tone of this update more relevant than those over the past 18-24 months since the stock market has essentially gone straight up over that time, establishing new highs along the way? Paradoxically, perhaps it is because of the new highs, or the psychological impact to be precise. In this age of information and awareness, the concept of a secular bear market is not as foreign as it was during the 1970’s bear. While it was not even on investors’ radars when we first began warning of a new secular bear market in the early 2000’s, after two 50% corrections, it has become a part of the consciousness of the investment community, at least off-Wall Street. It is doubtful that most investors in 1973 had ever even seen a historical chart of the stock market. Today, every investor with a computer and an inkling of risk aversion has at least been made aware of such long periods of languishing returns.

Therefore, although the secular bear market view may not have become the consensus view, it certainly has become mainstream. Unsurprisingly, this has led to timid (though, not extremely so) behavior by investors. Since the market tends to inflict the most pain on the most people, perhaps the bear has been in hibernation the past few years because there just wasn’t enough money invested to do enough damage. That behavior has changed over the past 12 months concurrent with the new highs in the market. Money has flowed into stocks at a frenzied and historic pace (see our June 2013 Newsletter). Calls heralding the dawn of a new secular bull market have become commonplace and the secular bear market meme is now being dismissed. So while we are not suggesting that an all-time high in the stock market is bearish in and of itself, the return to non-consensus status is precisely why the risks associated with a secular bear may re-emerge at this time. In our October Newsletter, we indicated that the conditions which tended to characterize tops within secular bear markets were in place. Since our evidence here suggests the secular bear market has not ended, risk is exceedingly high right now.

Let’s look at the aforementioned evidence.

Disclaimer: While this study is a useful exercise, JLFMI's actual investment decisions are based on our proprietary models. Therefore, the conclusions based on the study in this newsletter may or may not be consistent with JLFMI's actual investment posture at any given time. Additionally, the commentary here should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies.

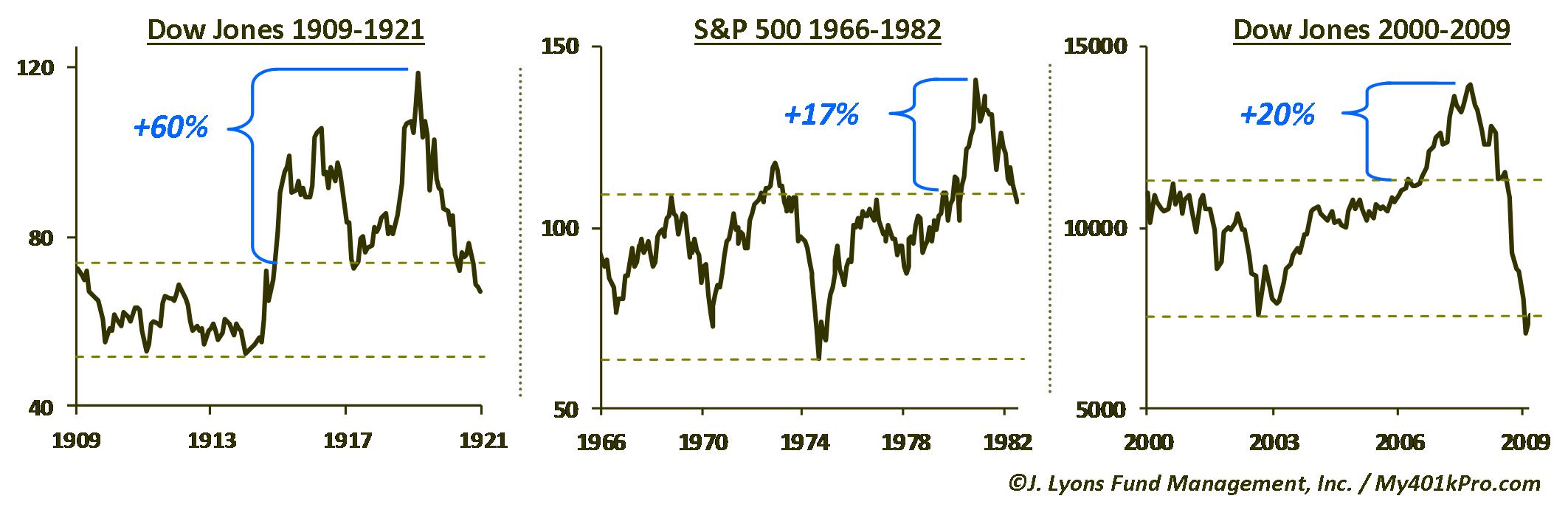

New Stock Market Highs

First off, let’s address the issue of new highs in the stock averages. If the definitive characteristic of a bull market is higher prices, why don’t the new highs necessarily confirm the onset of a new secular bull market? Certainly, on a “cyclical” basis, the higher highs leave no doubt that the post-2009 bull market is still alive. However, as it relates to the long-term secular cycle, the key is “sustainability”. A secular bull market is characterized by sustainable higher prices. It is not unprecedented during a secular bear market for prices to temporarily make new highs above the bear range only to return to the range. For example, during the 1909-1921 secular bear market, the Dow Jones Industrial Average spent much of the final six years above the top of the initial bear market range, by as much as 60%. Before the new secular bull started in 1921, however, the Dow was back below its 1909 levels. During the 1966-1982 secular bear, the S&P 500 traded above prior bear highs in 1972 and 1980 by as much as 11% and 17% respectively before returning to the range. Likewise, in 2007 the Dow traded nearly 20% above its 2000 peak only to drop to new secular bear lows in 2009.

Therefore,

new market highs do not automatically spell the end of the secular bear

market. Certainly, if the stock averages continue higher unabated,

without revisiting at least the top of the prior secular bear market

range, the secular bear thesis will be invalidated. However, if prices

return again to at least the top of the secular bear range, the bear is

still alive. The latter is the likely scenario in our view for the

reasons outlined below.

1982-2000

Excesses Yet to be Repaired

To refresh, a secular bull market is a long-term rally (think 1-2 decades) during which factors pertaining to equity investment, including prices, valuation, sentiment, etc., move from extremely low levels at the onset to extreme excess at its culmination. Newton’s 3rd law demands an equal counteraction to this move: a secular bear market. During the subsequent bear market, the bull market excesses are repaired, or worked off, putting the market back into a state that can support a new sustainable secular bull market. The key to this corrective secular bear counteraction is that it must be “equal” to the initial secular bull action. To be sure, attempting to ascertain “equal” when measuring such vast and intricate things as a secular market cycle is a difficult and subjective task. However, we are confident of one thing. By historically important measures, the recent secular bear market has not yet reached a point that could be considered equal in magnitude to the 1982-2000 secular bull market that registered massive, unprecedented levels of excess.

Time

The concept of action:reaction can be applied to time as well as activity. While the saying goes that “time heals all wounds”, time is actually an ingredient as well as a necessity of healing. A physical wound, for example, needs time in order for healthy cells to regenerate or repair themselves. The same goes for markets. They reach a level of psychological euphoria at the culmination of secular bull markets that needs to be repaired before a new bull market can begin. Such a shift in psychology takes time. During the initial portion of a secular bear, investors remain in the bull market mentality. They continue to buy each small dip thinking the strong upward trajectory of the prior bull period is still the norm. After a few big blows to their portfolios, investors become resigned to the existence of a bear market. Eventually, during the latter stages, investors are so disenchanted that they shun markets almost entirely.

Each secular bear cycle is unique in the length of time that it takes to repair the prior bull market excesses. Historically, however, the duration of secular bear markets have been of the same general order of magnitude as the preceding bull market.

| Secular Bull Cycle | Secular Bear Cycle | Bear:Bull Duration % |

| 1896-1909

(13 years) |

1909-1921 (12 years) | 92% |

| 1921-1929 (8 years) | 1929-1949 (20 years) | 250% |

| 1949-1966 (17 years) | 1966-1982 (16 years) | 94% |

| 1982-2000 (18 years) | 2000-2009? (9 years) | 50% |

Price

The most obvious way to consider cycles is in terms of price. During a bull market, prices go up and during a bear market, prices go down. And per Newton, the farther they go up, the farther they tend to correct, eventually. As we have discussed many times, however, during a secular bear market, prices do not necessarily decline the entire time, otherwise equity markets would be roughly where they were 200 years ago (although, on an inflation-adjusted basis, that is probably closer to reality than most people think.) No, during the duration of a secular bear, prices merely do not go up. This is where “time” factors in again. There is an old adage that markets can correct either in price or in time, i.e., by going sideways for an extended period. A correction in time is what often occurs during a secular bear.

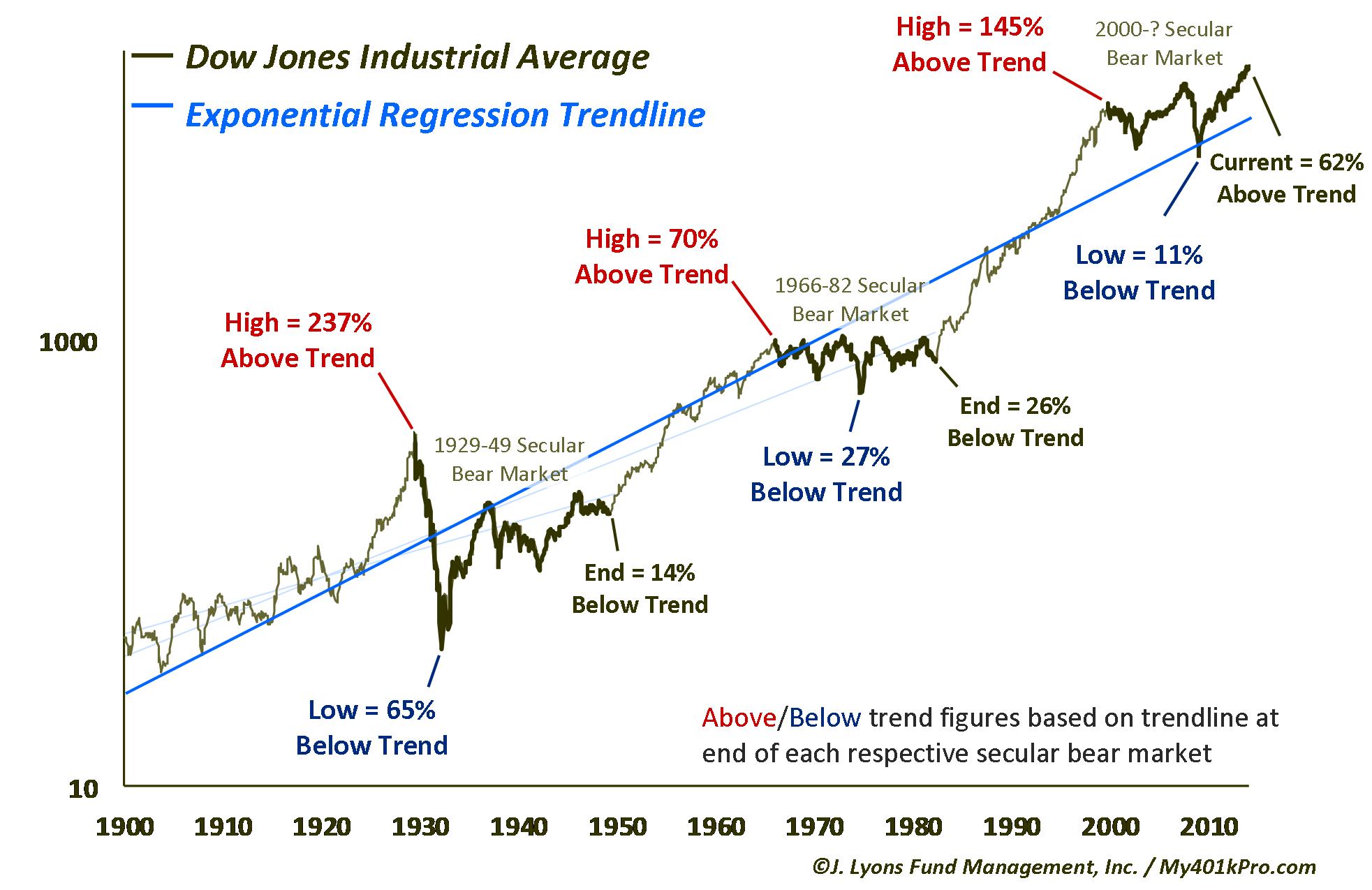

The extent of a secular bull market rally elicits an obvious, measurable “action”. However, to satisfy Newton’s law, we must determine what constitutes an equal reaction in prices during a secular bear market that goes sideways. To aid in this endeavor, we can use some math to figure out to what extent prices vary during a secular bull and bear market relative to their long-term trend. In the chart below, we apply an exponential regression line to the Dow Jones Industrial Average, producing a trendline that best represents the market’s long-term trend, or norm.

The

labels on the chart indicate how far above (overbought) or below

(oversold) the market got relative to its trend at secular bear market

tops, bottoms and ends (the figures are calculated as of the end of

each respective secular bear market so that trend is not effected by

future prices.) At the 1929 top, the Dow reached a staggering 237%

above trend. Such a severe overbought level would imply an equal and

opposite reaction to the downside. Sure enough, at the subsequent price

low in 1932, the Dow had fallen 65% below trend. And while the low was

established just three years in, as we discussed, time is an important

aspect to the secular cycle in order to make long-term repairs to

excesses that can’t be fixed through one quick crash in price. Thus,

the market generally moved sideways for the next 17 years. The sideways

action resulted in a market that at the end of the secular bear was

still 14% below its long-term trend – and in position to support a new

durable secular bull market.

Likewise, at the 1966 secular top, the market had reached 70% above its long-term trend. At the 1974 secular bear low, it was 27% below trend. While that perhaps does not seem to fit the “equal and opposite” bill, the time factor again played a significant role in repairing market excesses during the 1966-82 secular bear market. After generally going sideways for another 8 years, the market was still 26% below trend when the secular bear ended in 1982, even though the Dow was 30% higher than the 1974 low.

Comparing

the current cycle to those historical precedents makes it clear why we

do not believe the excesses built up by the end of the secular bull

market in 2000 have adequately been worked off. At the 2000 top, the

Dow was 145% above its long-term trend. At its low in 2009, it reached

a mere 11% below trend. Furthermore, it only spent 2 months below

trend, the only 2 such months in the last 22 years. This hardly

constitutes an equal and opposite reaction to the extraordinary heights

reached in 2000. So what would? Ominously, an instantaneous drop of 38%

would merely bring the market back to its long-term trend. Alternately,

so would a market that goes sideways for the next 6 years. Again, that

only gets the market back to its trend. To satisfy the equal and

opposite law would require even much more dire scenarios than those.

Valuation

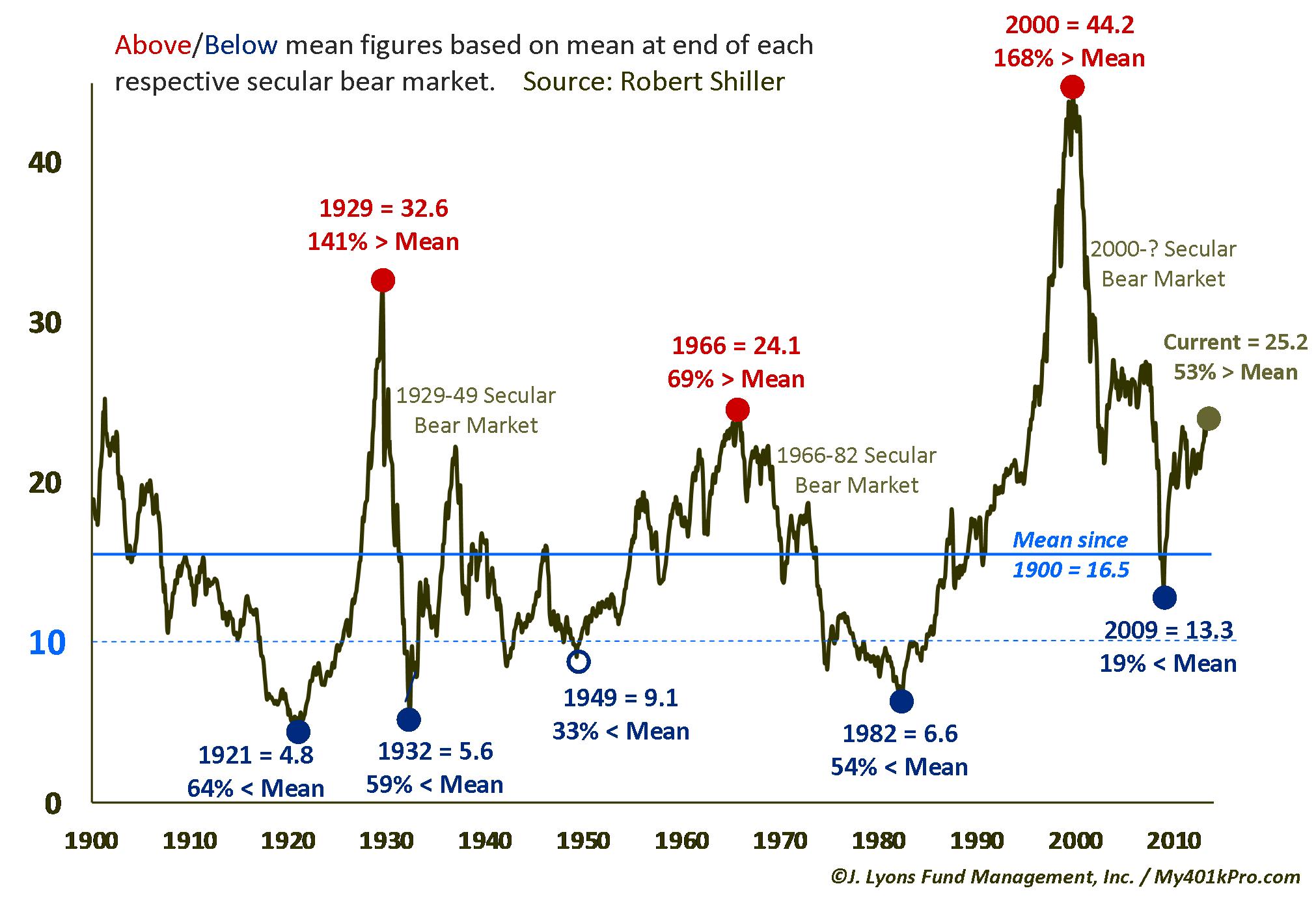

Like prices, all matters of ancillary metrics related to the stock market reach an extreme at the end of a secular bull market that must be met with an equal reaction in the opposite direction during the subsequent secular bear. This includes valuations, i.e., how expensive the market is relative to the underlying stocks’ fundamentals. Valuations, such as the ratio of price to earnings, get pushed to extremely expensive levels during euphoric secular bull tops and reach relatively cheap extremes at the end of secular bears. As we have in the past, we will use the cyclically-adjusted price to earnings ratio (CAPE) as an example. The CAPE method averages earnings over a ten year period in order to smooth out temporary dislocations in fundamentals such as occurred during the financial crisis in 2009.

After reaching an

extreme in valuation at secular bull

tops in the early 1900’s, 1929 and 1966, CAPE reacted in an equal and

opposite way during the course of each respective ensuing bear market.

In 1929, the CAPE ratio reached 141% above its long-term mean.

Subsequently, it dropped to 59% below the mean by 1932. The secular

bull top in 1966 was accompanied by a CAPE reading 69% above the mean,

followed by a secular bear low in 1982 at 54% below the mean. The

current cycle saw the CAPE reach an all-time high of 44.2, or 168%

above the long-term mean, in 2000. A move to that extreme

would beg a move to an eventual extreme in the opposite direction. Yet,

the low CAPE in the secular bear market since, registered in 2009, was

just 19% below the mean. That is hardly an equal and opposite reaction

to all-time high valuations.

Furthermore, on an absolute basis, by the end of each secular bear market in 1921, 1949 and 1982, the CAPE ratio had fallen to single digits. The current cycle low in 2009 only hit 13.3. We should expect that to fall significantly lower based on historical standards before a sustainable secular bull market is launched. Incidentally, the current CAPE reading of 25.2 is at or above levels reached at the top of the secular bull markets in 1966 and the early 1900's. That is somewhat alarming, especially given the abundance of voices telling us that the market is not expensive.

As an aside, some people make the case that 2009 valuations were low enough to mark the end of the secular bear, particularly given that valuations bottomed in 1932, well before the end of the 1929-49 secular bear market. We have reason to argue against that case and will explain in a forthcoming newsletter.

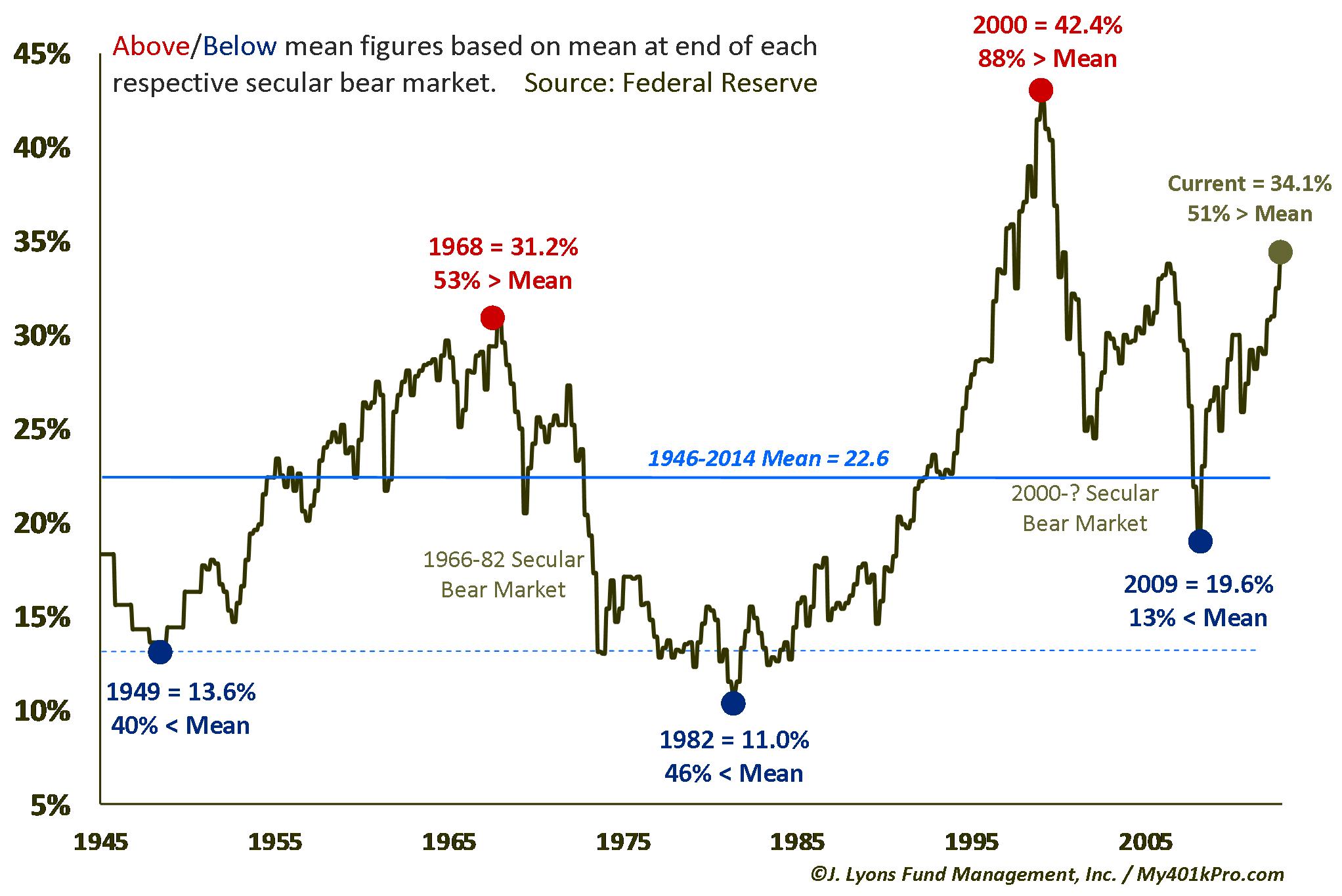

Investment Behavior

As discussed, secular bull markets end in a condition of relative investor euphoria. They don’t always end in a bubble (e.g., 1929, 2000 Nasdaq) but they do always end with a measurable extreme in bullish behavior on the part of investors. One of our favorite measures, simply because the series goes back longer than most data pertaining to investor behavior, is the percentage of households’ financial assets that are invested in stocks. As we have shown many times, households (like most investor groups) are least invested at the beginning of secular bull markets and most heavily invested at the end. This is not surprising as the imbalance reaches a point where there are relatively few buyers left at the top and few people left to sell at the bottom.

Unfortunately

the data (from the Federal Reserve) does not extend back to the

beginning of the 1929-49 secular bear market as it would be interesting

to know the level of household investment at the euphoric 1929 top.

However, at the end of the bear in 1949, households had less than 14%

of their assets in stocks, a reading 40% below the long-term mean. By

the end of the 1949-66 bull market, household investment had

more

than doubled, reaching as high as 31.2%, or 53% above the mean. As the

1966-82 secular

bear unfolded, investors gradually pulled their money out of stocks

again until they were left with just 11% of their assets in the

market, or 46% below the long-term mean. Predictably, this

was exactly at the beginning of the massive 1982-00 secular

bull.

It is interesting to note, as we have many times, that the low in stock

prices during the 1966-82 bear actually occurred in 1974 yet household

investment continued to decline until 1982. This reflects the

psychological impact of the latter stages of a secular bear wherein

investors simply get frustrated by the inability of stocks to make any

upward progress that they eventually lose trust in the asset class.

So what about the current cycle? At the top in 2000, households had a staggering 42.5% of their financial assets in stocks, 37% higher than the previous record high in 1968 and 88% above the long-term mean. Newton’s law demands an equal reaction to this extreme, i.e., an extreme low level of household investment, before the secular bear market is finished. This has yet to occur. At the lows in 2009, household stock investment fell to about 20% of assets. While down 50% from the 2000 high is certainly an improvement, at 13% below the mean, it is hardly an equal and opposite reaction. And on an absolute basis, we would expect the level to approach the 1949 and 1982 levels in the low teens before considering it to be an equal reaction to the 2000 upside extreme. At those levels, a new sustainable secular bull market could be supported.

Conclusion

Market Analysis

Newton’s Third Law of Motion states that “for every action, there is an equal and opposite reaction”. Historically, this law has been as applicable to price behavior in financial markets as it has in the physical world. Markets, indicators and investment behavior which cycle to one extreme tend to eventually visit the opposite extreme before the cycle is complete. As such, the excesses associated with the stock market that were attained at the end of the secular bull market in 2000 should be unwound to an opposite extreme before a new, sustainable bull market can begin. By the various measures that we looked at across time, price, valuation and investor behavior, the excesses have not reached an equal and opposite extreme. In fact, some measures are closer to levels of excess than the opposite. And while there is much debate over whether or not the actions by the Federal Reserve are responsible for the recent leg up in equity prices, we have no doubt that their actions have contributed to the sustained levels of excess and forestalled the necessary repairs to market conditions. These conditions suggest that the secular bear market is not yet over. Furthermore, according to analysis we have done in the past on tops within secular bear markets, risk is extremely high at the current time.

Investment Principle

What does all of this mean for investors? First of all, for investors, or traders, who employ an active risk-managed approach to investing (or have an advisor who employs such an approach), it likely has little relevance for their investment process. Presumably, their process would provide protection should the potential risk we are warning about manifest itself. However, for those investors without a risk-managed investment approach, for those employing a buy-and-hold approach and especially for those who employed a buy-and-hold approach until bailing out near the market lows in 2008-09, it has serious implications. Undergoing even a scenario that merely returns the market to its long-term trend in the upcoming years would be devastating to their portfolios, not to mention their investment psyche. This is especially true for the multitude of investors -- based on money flows -- that have just recently returned to the market, or are contemplating do so, after missing out on most of the gains of the past 5 years. They can hardly afford another blow. Our advice is to seek help via an active risk-management strategy or an advisor employing such a strategy that can help avoid the types of losses that place one’s portfolio in such a dire predicament to begin with.

Dana Lyons

The

commentary

included in this newsletter is provided for informational purposes

only. It does not constitute a recommendation to invest in any

specific investment product or service. Proper due diligence should be

performed before

investing in any investment vehicle. There is a risk of loss involved

in

all investments.

| Tweet |

|

|