J. Lyons Fund Management, Inc. Newsletter

| May 2012 |

Posted May 5, 2012 |

| Tweet |

|

Recovery or Wishful Thinking?

Encouraging economic and market data of late are likely just buying investors time to seek shelter rather than signs of a sustainable turn.

“The

propensity to believe in reason and the inevitability of progress makes

it difficult for most people to accept

the existence of economic and financial cycles. Leaders in these

spheres seldom comment on cycles, except perhaps to dismiss their

relevance. Like Edward Simmons, President of the New York Stock

Exchange, who bravely announced in

September 1929, the very month that the great bull market peaked, ‘We

are apparently finished and done with economic cycles as we have known

them.’”

- Ian A. Gordon

Bolder Investment Partners

As several of our Newsletters and client Quarterly Letters over the years have accurately stated and documented, we feel we have been in a secular bear market and will be for several more years. I don’t necessarily say this pridefully. The pattern of such secular bear markets over the past 200 years is so obvious that anyone who was being objective and not trying simply to attract client money with promises and predictions of great bull markets ahead could easily see that it was time for such a market cycle. Moreover, the market’s clock precisely called the hour for such an occasion. So too did the excesses in the economy and society, conditions that always accompany the scene prior to such a difficult time. Such rough periods seem to accomplish a natural purging that rids the environment of such excesses. We think that purging has further to go.

Recently, the stock market has been exhibiting rather pronounced recovery signs which, while premature in our minds, are very much to be expected. Mankind still views the future through its rear view mirror and there is still the thought that we are headed back to the good old days. However, in fact, it is our belief that the current growth is only filling the vacuum left when the economy took its nosedive a couple years ago.

Because we are not economists, we will not go to the wall with any economic forecasts. However, I am more confident that the stock market is not off to the races despite the recent good performance. Let’s briefly review what we have been saying for the past several years and then why we continue to be less than encouraged that something better will occur than what might be expected during the last third of this bear cycle.

Note: While this study is a useful exercise, JLFMI's actual investment decisions are based on our proprietary models. Therefore, the conclusions based on the study in this newsletter may or may not be consistent with JLFMI's actual investment posture at any given time. Additionally, the commentary here should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies.

Recovery Headwinds

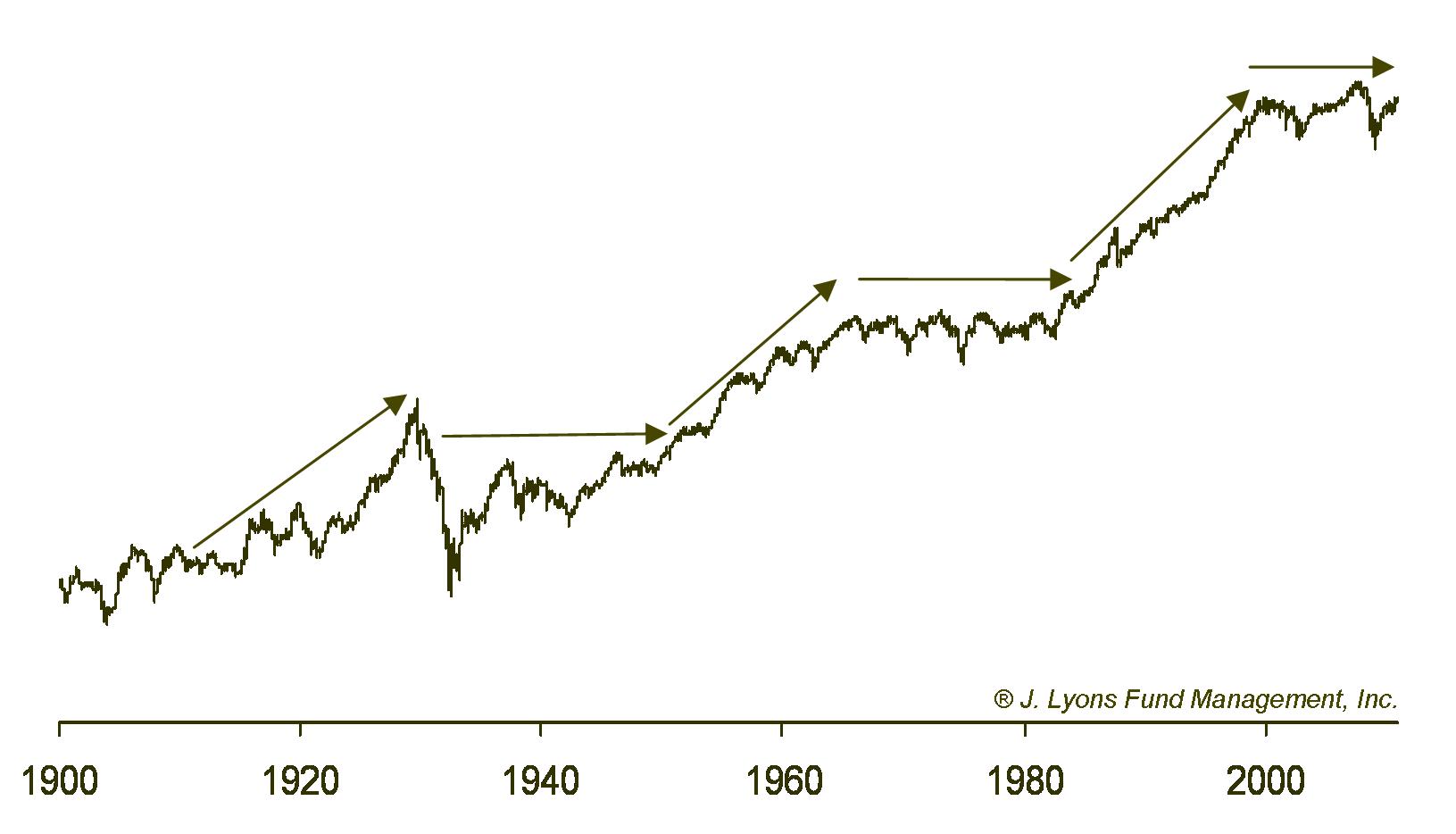

First of all, historically, secular (long-term) bear markets have averaged 18 years in length as have the alternating secular bull cycles. The current bear began precisely on cue in 2000 and ended one of the great bull runs that began in 1982. Moreover, we point out that during secular bear markets, the stock market goes nowhere despite its wide swings. That is precisely what has happened since 2000 -- the first two-thirds of this cycle.

To us it is almost foolhardy to now ignore the existence of

the repeat of that 200-year old pattern much less decide that somehow

the rest of it won’t unfold and that the problems are over and it’s

time to get back to investing as usual. However if you listen to the

pundits on CNBC and elsewhere, you will mostly hear a bullish case

repeated over and over again.

In addition to this long-term bear market arriving right on schedule and subsequently performing exactly as it was expected to, can a credible bullish case really be made when:

- Almost everything, economically, that we can think of is much worse at this time than at the corresponding two-thirds mark of the last secular bear market (see our May 2011, June 2011 & July 2011 Newsletters for evidence of this.)

- The state of Europe is still poised on the brink of disaster. And we are supposed to think that more debt is the solution to rescuing countries from being over their heads in debt already?? Or moreover, that future growth will be strong enough to bail them out?? That is the ultimate in wishful thinking -- and folly. Check out the attitude of much of the Greek & Spanish populous. Are they really ready to partner in an austerity program much less roll up their sleeves and contribute, a.k.a. actually work, to contribute to the achievement of the subsequent requisite growth? I don’t think so. It appears that the steps being advocated are only to procure more bailout dollars to prevent an immediate meltdown and have much less of a chance of curing the systemic problem.

- That fallacious thinking in Europe is only equaled by the U.S. and several states that still are not seriously addressing their dire financial position but are actually adding to it. Do we really believe that it's possible to have a meaningful recovery much less a robust one commensurate with current bullish stock market projections when states like Illinois and California can’t even pay their bills, yet are doing effectively nothing to remedy the situation?

- California’s public pension plans are underfunded by as much as a half trillion dollars and Illinois’s by over $100 billion. Those are holes too deep to climb out of without drastic reforms. And though some might disagree, when remedial steps are taken as in Wisconsin, the culture of a misguided public calls for the removal of the person in office wanting to implement such reforms. The culture that has grown to characterize much of society is as difficult a problem to change as is the actual debt situation.

- If these reasons aren’t enough to thwart any significant recovery near-term, there is but another tsunami upon us -- that being the result of the over-marketing of and subsequent over-indulgence in student loans. Those loans, as of 2010, actually exceeded credit card debt for the first time with an outstanding balance projected to be in excess of $900 billion. Again, such willingness to assume this debt has in part been due to the culture of borrowing that has been upon us. But it has certainly been aided and abetted by the wanton and even scandalous increase in the costs of going to college. The average student now is said to have 8 to 12 loans for his undergraduate years and outstanding debt of over $25,000.

Unlike with home loans, one cannot walk away from student loans even when declaring bankruptcy. This problem has major implications for the economy as young people will delay important and economically stimulating steps like marriage, family formation and buying homes. Who will buy, for example, the immense pool of homes now on the market much less those that retirees will be wanting to sell in order to raise funds to support their ill-prepared retirement years? This is indeed another problem approaching the magnitude of the housing debacle and one that will retard recovery for years to come.

So here are the facts. We have now traced out precisely 12 of the normal 18 years of a secular bear market that has repeated itself for over 200 years -- and have done it exactly on schedule. I believe it would be presumptuous at this point to think that the stock market will make any real, sustainable progress during the cycle’s remaining (at least) 6 years. Moreover, as outlined, we have enormous unsolved, and perhaps insoluble, economic problems, ones that not only are severe and ongoing but are embedded in the culture. Despite the ease with which many, including Congress, dismiss the bleak potential for a resolution to these problems, I unfortunately cannot.

OK,

What Now?

What to do is the question. It would seem that the secular bear market must do its natural work which is to purge the system of its excesses. There is no silver bullet that would allow us to avoid that process. One of the excesses of the previous secular bull market is that we have come to believe that somehow it is an injustice to be uncomfortable; but until and unless we learn to handle adversity, the process cannot be completed. Simply throwing money at the problem at this point only exacerbates and increases the depth of the problem that eventually must be addressed. However, the “throwing of money” seems to be the only solution Washington and governments in general are adept enough to consider.

As we have maintained for years, one absolute essential is to explore ways to invest other than simply buying-and-holding, or its equivalent, i.e., simply ignoring your investments. (see our “Here Lies Buy and Hold” piece from a few years ago.) The retirement crisis in this country is only going to get worse and being proactive in addressing the nurturing of retirement funds is critical. Consider again the following stat that we mentioned a few months ago as yet one more wake-up call supporting that advice:

On Leap Day 2000, the S&P 500 closed at 1366. On Leap Day Eve 2008, the S&P 500 closed at 1367. Amazingly, this past Leap Day, February 29, 2012, the S&P 500 closed at 1366 once again. So much for Wall Street and academia's buy-and-hold mantra.

Investors have a choice: they can adopt a strategy they know may lead to many small mistakes or they can risk making the predictable very serious mistakes by buying-and-holding. The latter will, sooner or later, blow them out of the water and probably seriously impair their retirement plans, e.g., 2000-03 & 2007-09. (The last sentence is a paraphrase from a fellow advisor, Paul Merriman.)

Investment Survival Imperatives

Due to our risk avoidance strategy, our clients only incurred relatively small losses following both the bursting of the tech bubble in 2000-03 and the housing crisis in 2007-09 when the S&P 500 lost 50% and 57% respectively. That was solace to clients and kept them from the “under the mattress” strategy. While it may be obvious, limiting losses is the most important factor in managing one’s money. Obvious, yes, but easy, no, unless you have no desire to attempt to grow your investments at all.

A second reality and one that has taken on an increasing significance in both the face of this difficult economy and with the occasion of the emergence of other world economies is the question of where should one be investing their money. No longer are the investment choices restricted to only U.S. alternatives. Fortunately, there now are investment alternatives available that represent almost any conceivable investment product, geographic and otherwise.

While this investment array presents an opportunity to survive or even prosper in any market by investing in or even hedging using this diverse selection, it is nearly impossible for casual investors to successfully navigate that process. It is a task best left to certain professionals. This is not meant at all as a slight but the reality is the vast majority of people are not equipped to manage their investments. This is, of course, mostly due to a lack of time, experience, and expertise. Unfortunately, most do not take the time to search out appropriate assistance either.

Conclusion: It's Time for Action

Suffice it to say that these are perilous times for investing and retirement planning, whatever your age. Both active and serious steps must be taken to tend to your investments if you do not want to end up ill-prepared in future life -- or current life if you are already retired. There will be more good opportunities to capture much needed profits. The key, however, is both to have 1) protection in difficult times and to be available to 2) exploit those favorable opportunities. While no investment strategy can be accomplished with perfection, every strategy should at least attempt to execute in both of those areas. That is certainly our objective.

Our advice is to seek out an investment manager that will actively manage risk while in pursuit of long-term investment growth. Whether it is JLFMI (contact us) or another competent manager, we strongly recommend that you take action immediately. Given the very recent favorable investing climate, now is the time to address one’s retirement investments -- before the next storm hits. There is still very much at stake and the next decline in this secular bear market will be the third strike for many.

John S. Lyons

The commentary included in this newsletter is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.

| Tweet |

|