J. Lyons Fund Management, Inc. Newsletter

| November 2010 | Print Version |

Here Lies "Buy & Hold": August 1982 - February 2000

(Still in the grave ten years later)

“I took the road less traveled

by.

And that made all the difference”

The Road Not Taken by Robert Frost

Buy and hold, buy and hope, buy and fold. As much as it is inevitably destined to fail, “buying and holding” has been the “road most traveled”. Investors have been hoodwinked by the Wall Street establishment into believing that one must be completely misguided not to employ buy and hold. Despite the fact that buy and hold would have worked well over the entire period from 1982 through February, 2000, very few investors ever experience success with it. That is the essence of the problem with this investment technique. It makes sense in the classroom but has little chance of aiding the vast majority of investors in practice.

Yet, buy and hold investing is espoused by Wall Street and, as a result, by the financial press and the grass roots financial planning community. It is one of those beliefs whose mythical success is unchallenged simply due to its popularity and ease of use, not because of its objectively proven efficacy.

Update: After another devastating bear market from 2007-2009, one has only to ask themselves, as on many other dates in history the following: "whether the market comes all the way back in the next few years or not, wouldn't I feel better if I weren't facing the task of rebuilding a portfolio that was down as much as 50%?" I don't care if you're 20 or 70 years old, ask the same question. It seems to be popular Wall Street wisdom that younger people don't mind getting beaten up in the market as much as older people. I don't think so. They just may not be as frantic.

Why the Popularity…

The reasons for buy-and-hold's popularity are basically two-fold. First of all, it best serves the bottom line of Wall Street brokerage firms and mutual fund companies. These firms have but one overriding objective. That is to “gather assets” and then to have those assets be the source of income generation which will obviously impact their bottom lines. Despite the fact that this goal by itself is noble enough, the problem enters when it becomes incompatible with good investment advice, such as “go to cash”. To give a client such advice would risk stopping the income stream as well as losing the client altogether.

Secondly, buy and hold is popular because it really doesn’t take any investing acumen to employ it. That is basically why most individual investors adopt it as their own strategy.

Additionally, the thousands of financial planners in this country who take a year or a two year course to get their credentials for the most part have no experience in managing investments. When they decide that managing money would be a good revenue source alongside their financial planning, buy and hold is not only the most obvious choice, it is the only choice they might be capable of even attempting to quickly implement. While one may learn much about the intricacies of estate planning and taxation from correspondence courses or in a classroom, I maintain that to come to grips with investment markets, literally years of experience are required.

Update: While financial planners might be excused for not having the tools to try to protect investors, Wall Street cannot be. Most firms have market analysts and technical analysts and have had them for decades. I imagine these analysts cringe when their firm's message to investors is to just passively run headlong into the regularly occurring bear markets -- and then have to endure the resulting condition of not having the stomach to open their monthly statements for a few years. No, the state of investment tools is beyond not being able to protect clients. There is more to it than that. Needless to say, we don't have to discuss how important it is to retain investors' assets in order to make year end bonuses on Wall Street.

The Debate…

The argument over market timing versus buy and hold investing rages constantly. My intent is not to urge investors to attempt market timing themselves without the extensive experience and time commitment needed to develop a sound, unemotional system. Without such preparation, the chances of success in such an endeavor are very low. Rather, it is meant to inspire investors to carefully consider the advice they are receiving -- that the only way to invest is to buy and hold -- and to take the time to carefully consider other investment counsel. Those who say market timing can’t be done usually fall into one of three categories or some combination of them: those who never tried it, those who tried and failed and those who have a vested interest that prevents them from being objective about it.

It would seem obvious after a decade which saw the stock market go nowhere (at best) that buying and holding is a failure; however, its proponents continue to march into the jaws of investment destruction with proud suicidal tenacity.

Update: The term "market timing" predates the bastardizing of that process by Eliot Spitzer, the now disgraced ex-governor and former Attorney General of the State of NY. He used it incorrectly to label trading foreign mutual funds whose prices weren't current with the closing prices of the stocks within (a perfectly legal endeavor, by the way). The correct definition of "market timing" is determining when the market risk is too excessive to warrant investing or low enough to accommodate investing. We should know as we were among the pioneers in developing that process back in the early-mid 70's.

Problems with buying and holding in light of the real world

Problem #1: In reality, investors buy high and sell low.

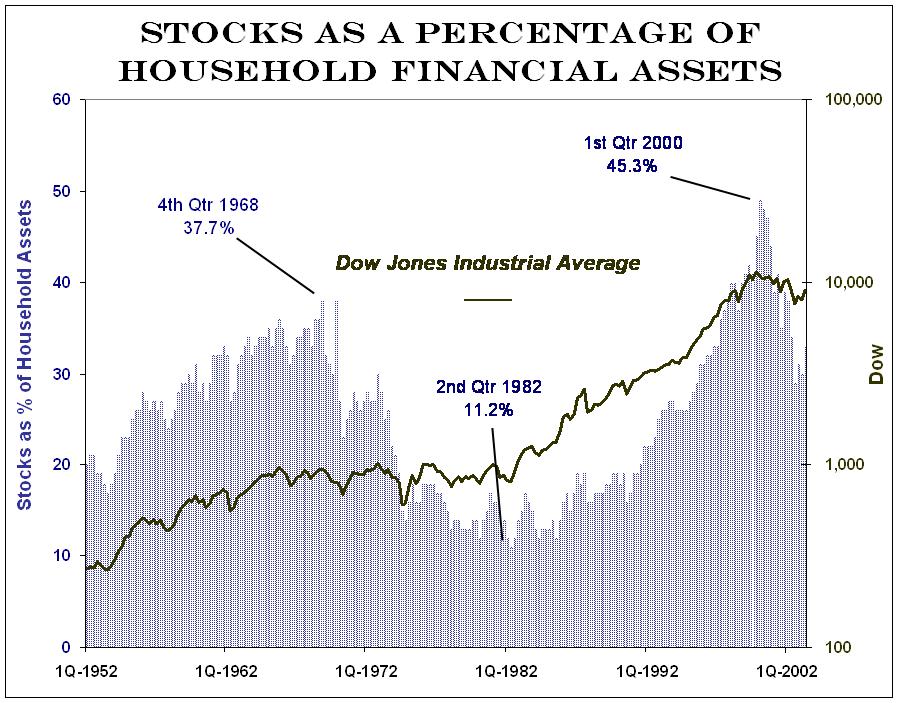

During the past secular bull market from 1982-2000, investors really shunned the stock market until at least 1992 as can be seen by the chart. Even by 1992, they only started sticking their toes in the water. This chart clearly shows one reason why buying and holding doesn’t work - the investing public puts the least amount into the equity market at lows, see 1982, and the most at highs, see 2000.

Moreover, in January and February of 2000, at the exact top of the market as measured by the major weighted averages, investors put an amazing, record $94.5 billion into equity funds. That buying frenzy total compared to $18 billion in the same two months one year earlier. Such a manifestation of emotional investing is certainly an example of what drives investors.

Similarly, investors that bought heavily – and they did - at the top of the great bull markets ending in 1966 (as can also be seen on this chart) and in 1929 would have had to weather a decade or more of declining years, backing and filling years and recovery years just to get back to even. Such patience to “hold” for that period of time is rarely encountered in the real, non-academic world, I’m afraid.

Now, the same challenge awaits those involved in the buying frenzy that culminated in the months of January and February of 2000. It is pure foolishness to expect or to counsel investors to endure that experience. Those who suggest that buying and holding is the way to investment success would do well to take a stroll through the real world. While that technique may have a chance for success with the comatose investor, it does not have a chance for the vast majority of investors who happen to have the misfortune of being affected by human nature.

In fact, these instincts that elicit buying high and then holding constitute a foolproof formula for disaster. Unfortunately, these ubiquitous psychological aspects of investing that manifest themselves as fear and greed entirely escape proponents, academic and otherwise, of buy and hold investing. Not addressing such reality subverts any chance of success for unwitting investors.

Problem #2: Investors who

do hold from one bull market to the next own yesterday’s heroes.

One of the ancillary benefits of market timing is that it allows one to periodically “refresh” ones portfolio. An examination of any bull market will reveal that its best performing companies, as well as its largest companies in terms of both assets and market capitalization, will not be the same leaders in the next. In other words, the hypothetical buy and holder will end up holding a portfolio of stocks that represent yesterday’s heroes rather than today’s. An examination of the past once again reveals that the Polaroids and Xeroxes of the bull market that ended so badly in 1973-74 never did regain their luster and in fact many have flirted with financial ruin.

Update: Examine the shooting stars of the high flying Nasdaq tech market now that we have perspective regarding that period of the 90's. Many of them have completely disappeared and even the performance of the super heroes like Microsoft, Intel and JDS Uniphase have been investment shadows of their former selves during these past 10 years. I suspect that the Googles and Apples, etc. that have been the recent crop of heroes will also meet the same fate.

Problem #3:

Buy and hold does not address the most important principal of

investing (according to Warren Buffett, myself and many other

investment professionals) and that is not

to lose money.

Studies have shown that approximately 70-75% of the risk in a stock or a mutual fund can be labeled market risk. Only 25-30% is non-market risk. What that says is that far and away the biggest factor causing a stock to move up or down is the direction of the overall market. That fact, coupled with the pathetic job done by Wall Street analysts in getting investors out of stocks prior to devastating declines, makes it a no-brainer to assign a high priority to timing as the source of investment assistance.

Be fully aware that not only will security analysts provide little help in the all-important task of determining when to sell but, quite obviously, corporate officials will not admit to problems within their own firms until it is too late. Although there may be a brief effort to reform both Wall Street and corporate insiders from their failings in light of the travesties of recent years, to expect those changes to be long lived is the height of wishful thinking.

In seeking an investment adviser, the first question that an investor should ask a potential advisor is “how will you protect my portfolio from significant losses?”. If the answer is indefinite and cannot be backed up by clear evidence of success for some period of time historically, the investor should, without hesitation, go on to the next candidate.

Update: None needed.

In Summary…

When examined with objective scrutiny, market timing (also referred to as active management), if practiced well, is a superior technique to buying and holding. First and foremost, its goal is to protect a stock market participant from incurring injurious losses that buy and holders are inevitably going to suffer since no such protection is even attempted. Almost equally as important, by reducing exposure to declining markets, the necessity is eliminated for an investor to have to make decisions while under the pressure produced by having incurred substantial losses and still facing more.

Investors, as well as most advisors, typically have no benchmarks to guide them as to the amount of risk present in the market. As a consequence, they always perceive too much risk at times they should be buying and not enough risk when they should be selling (and I would underscore the latter.) Throughout the ages, with any investment vehicle, be it tulips or real estate or stocks, investors have always have had the most difficulty in determining when to sell. Perhaps the most important goal of market timing is to attain such guidance.

So unless the laws of human nature are repealed, finding timing advice to accompany one’s investment moves should be an investor’s highest priority. It will seem counter to the crowd to do so, but being successful in investing requires a contrarian’s mindset. As with other endeavors in life, if you find the road that you’ve chosen to take the one that is most traveled, it might be well to rethink the route on which you find yourself.

Final Update: After 40 years as a provider of professional investment assistance of one form or another, including a 20-year run on a business TV program in Chicago, I have concluded that there is one dominant problem with investors attaining good investment results. Yes, there are a lot of advisors of one type or another that do a poor job, and yes, investment markets are worthy adversaries. However, the most prominent reason for poor investment performance is that most people don't put any real effort into finding help. The problem may especially appear daunting to those who know nothing about investing. But doing nothing is not an alternative. Common sense and recognizing that investing is not a "get-rich quick" endeavor is what's needed for starters. Asking the question in Problem #3 above is critical. But by all means, remember that it's your money and it's your retirement that is at stake -- and both take on increasing importance with each passing year.

John S. Lyons