J. Lyons Fund Management, Inc. Newsletter

| October/November 2015 |

Issued To Clients October 15, 2015 |

| Tweet |

|

|

Red

Skies in the Morning…

Signs from the economy are not consistent with the optimism suggested by a stock market near its all-time highs.

“Over the past several months,

we have detailed the systematic

- JLFMI Newsletter, August 2015

In the August Newsletter referred to above [Internal

Combustion: Anatomy of a

Market Top - Part 1], we go on to say “The deterioration of

the broader

market is so great that the resultant foundation of support below the

surface

of the popular market cap-weighted averages is nearly non-existent.”

Indeed,

the stock market of the past few years has been an anomaly and the

minor recent

decline did little or nothing to correct that abnormality.

Regarding it being an anomaly, we are confident. Money

flowed in and took us to all-time highs primarily because it was the

only

option for the funds that were searching for a destination. For

starters, much

of the time during the past 5 years, corporations pulled in their horns

on

making capital expenditures due to the sluggish recovery from the

recession of

2007-2009, and to the less than business-friendly policies of the

current

administration.

Instead, they used the rapidly accumulating cash on hand to

buy back their own stock in record quantities, as well as to raise

their

dividends. And the magnitude of those actions was substantial in its

ability to

prop up the market. Buybacks are estimated to be on track to amount to

$1.2

trillion this year, according to a count by Birinyi Associates Inc. And

it’s

still going on.

Also during this time, banks were not aggressive in making

loans so they also were accruing mountains of cash. With interest rates

so low,

bonds were not an attractive option so the stock market again became

the

default option.

Disclaimer: While this study is a useful exercise, JLFMI's actual investment decisions are based on our proprietary models. Therefore, the conclusions based on the study in this newsletter may or may not be consistent with JLFMI's actual investment posture at any given time. Additionally, the commentary here should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies.

But How About That Economy?

Some may try to be convincing by stating that it is the sound footing of the economy that is the rationale for the all-time market highs. But that certainly has to be a reach, at best. The 2007-2009 recession was the most severe we have suffered since the Great Depression and there is no non-political argument that its recovery has been anything other than among the most anemic in our history. Moreover, the antidotes used to stem the problems in many cases produced the effect of lengthening the economic malaise in a very similar way to those used to remedy the challenges of the Great Depression. (I refer you to the carefully researched book New Deal or Raw Deal by Burton Folsom Jr., Copyright 2008, for more on that period).

Currently, the economy is still struggling to gain solid footing despite the rhetoric to the contrary that all is well. Moreover, the lack of appropriate fiscal policy has been much of the reason for the anemia as well as for the adverse effects on many geographic areas and certain segments of the population.

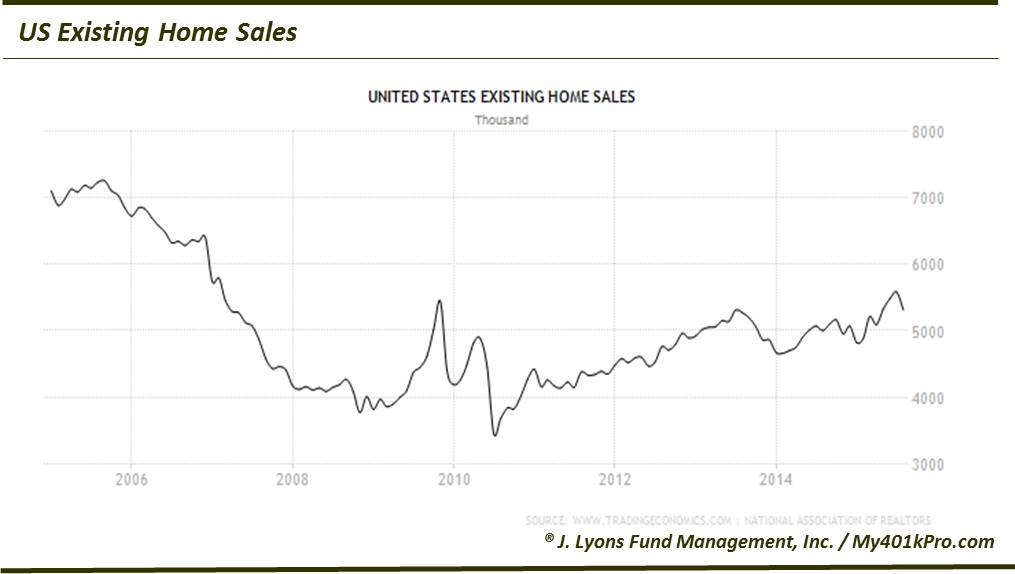

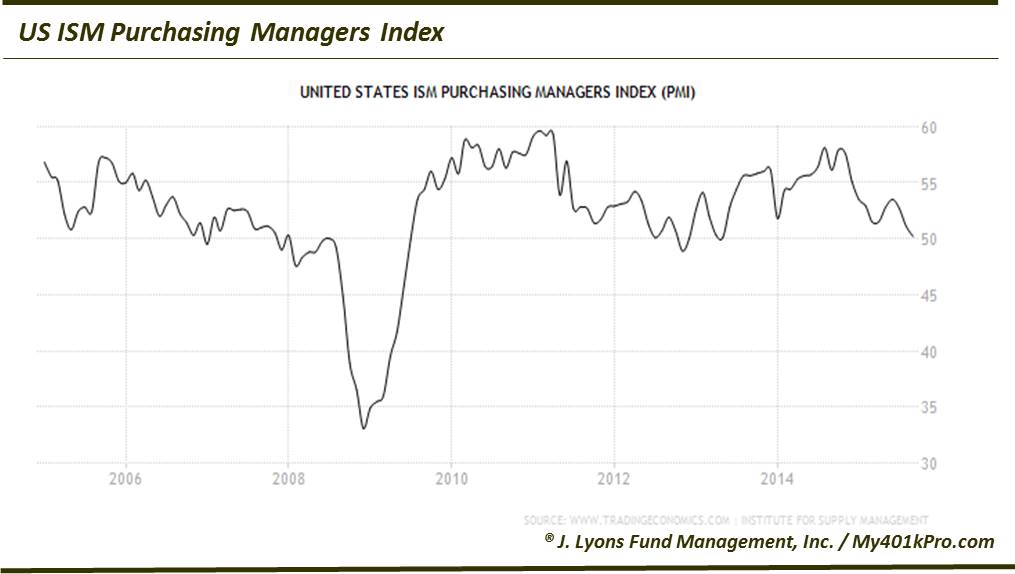

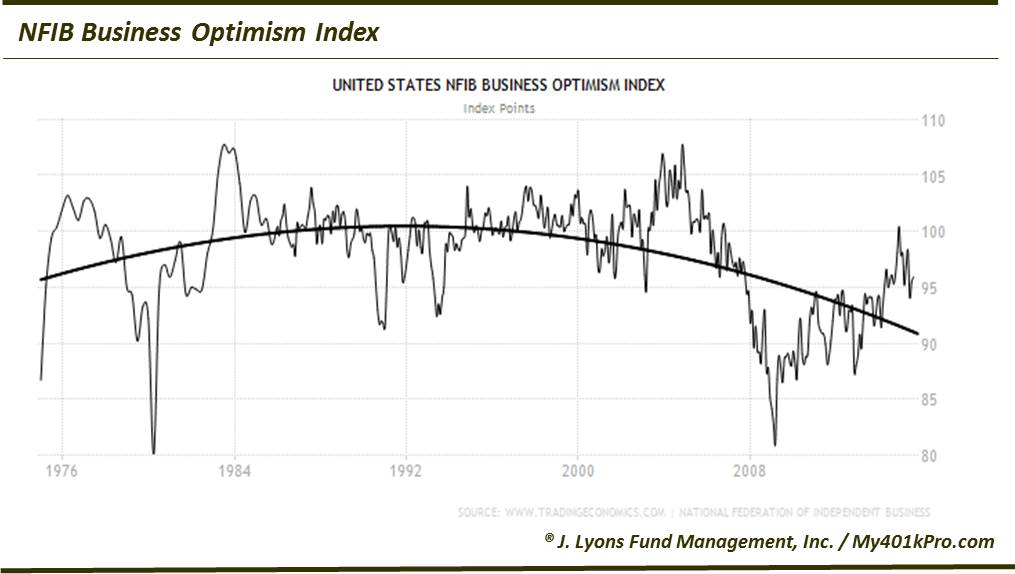

Let’s examine a few charts to see what the results are really telling us. The first three charts below clearly show that the current position of the actual recovery is not even at pre-recession levels - not according to the data and not according to optimism as indicated by the National Federation of Independent Business monthly survey.

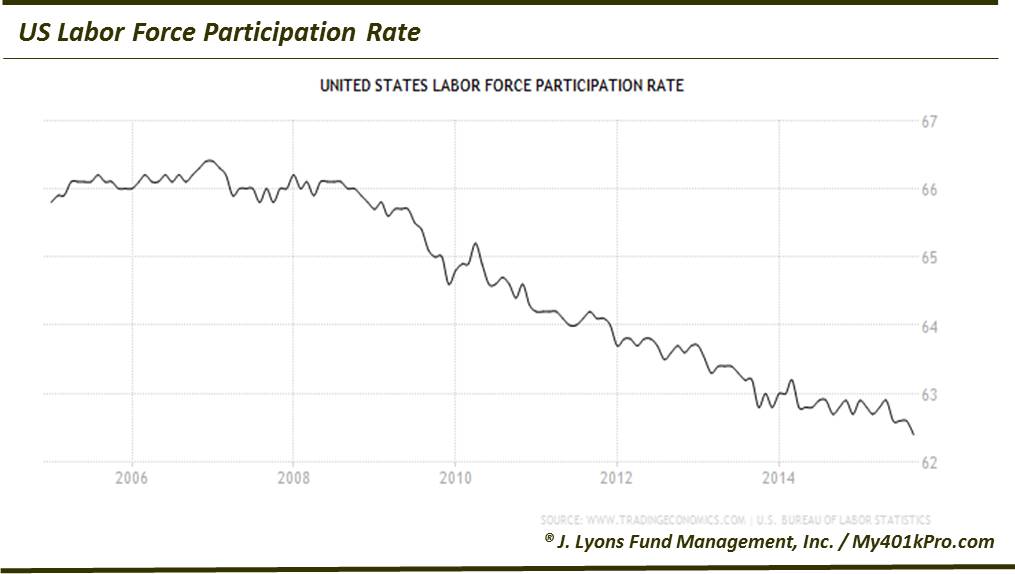

The next chart shows that not only is the economy not a sufficient backdrop to justify all-time highs in the stock market, but also that the severe recession and policies enacted afterward intended to assist American workers have indeed backfired. Moreover, the victims of this “backfiring” have been the middle class, the poor and youths. The unemployment rate for Black youths 16-19 years of age for example was 28.5 in December of 2007 and the most recent reading according to the bureau of Labor Statistics was 32% in September. Hardly progress. (The labor force participation rate is the percentage of working-age persons in the economy who are employed or unemployed but looking for a job.).

Clearly, something other than a robust economy has been the contributor to the strong performance of stocks over the past 5 years. This nation as a whole is not in great shape. Obviously the earnings of some companies have contributed to that market performance. But that strong showing has been aided to a great extent by increased efficiency and automation in addition to the boost in earnings per share brought about by the huge stock buybacks. Although temporarily, we are less bearish than we have been since June, we still project substantial risk in the foreseeable future.

Our reason for that conclusion combines A) the fact, as suggested above, that strength in the market over the last few years to the extent that it reached all-time highs was for the wrong reasons with B) the objective analysis we have done about the market’s tenuous position. Those “wrong reasons” persist today. Just a few days ago (October 15th) when it was hinted by a Fed member that the economy may not be strong enough to support a rate hike, the equity markets took a broad leap. Once again, bad news was good news for equities.

Add to that faltering economy, the fact that the recent collapse in the world’s commodities appears to have been underestimated as to its cause, its effect, and its potential duration and the case for optimism becomes more of a head scratcher. The cause of lower commodity prices, like everything else, is always simply a supply vs. demand situation. The health of the global economy simply doesn’t justify higher commodity prices. That situation not only is ominous in its own right but also is an expression of the worldwide weakness that is not going to go away quickly. In fact with all the turmoil in the world, a recovery may take years in our humble opinion. Optimistic projections of sustainable all-time highs in equity prices are unlikely to be compatible with that scenario.

Sailors (et al.) take warning…

Finally, we will conclude by calling attention once again to the three beginning quotations of our JLFMI 2nd Quarter Client Letter:

Jim Grant, author of Grant's Interest Rate Observer - “The price of the central bank's persistent easy money policies is on display currently in the form of stifling American enterprise and sending millions of people from the workforce 'more or less permanently'.”

Mohamed El-Erian, Chief Economic Adviser at Allianz - “There is a massive gap right now between asset prices and fundamentals.”

Bill Gross, Janus Capital Group - “Almost all assets are artificially priced.”

As stated in that letter, these men are three of the most respected commentators in the investment business. So if our caution is not credible, harken to theirs.

- No matter what asset one invests in in the foreseeable future, be it stocks, art, real estate, etc., there may be substantial risk.

- Liquidity will be significantly important in future investments.

- Investment planning that relies on nothing more than buying and holding will be in great peril. The ability to hedge investments (control risk) will be paramount.

- Those who are dismayed with the lack of performance of traditionally excellent hedge fund managers over the past few years may well be subject to the same emotions of those who rush to buy at market tops or who sell at bottoms.

- The world situation both economically and otherwise will take years to reverse.

- Finally, and sadly, 99% of investors will not avoid the risk we discuss.

We must hasten to reiterate that the rationale for our investment posture at all times is derived from the input that results in the readings we receive from our objective Risk Management Model as well as input we receive from our Fund Selection Model, rather than from our economic observations.

John S. Lyons

President

The

commentary

included in this newsletter is provided for informational purposes

only. It does not constitute a recommendation to invest in any

specific investment product or service. Proper due diligence should be

performed before

investing in any investment vehicle. There is a risk of loss involved

in

all investments.

| Tweet |

|

|