J. Lyons Fund Management, Inc. Newsletter

| April-May 2015 |

Issued To Clients April 15, 2015 |

| Tweet |

|

|

This

Time It IS Different!

Policy and market response to financial challenges HAS been different this cycle -- so far.

"The price of the central bank's

persistent easy money policies is on display currently in the form of

stifling American enterprise and sending millions of people from the

workforce more or less permanently."

-

Jim Grant, author of Grant's Interest Rate Observer

“There is a massive gap right now between asset prices and

fundamentals.”

-

Mohamed El-Erian, Chief Economic Adviser at Allianz

“Almost all assets are artificially priced.”

- Bill Gross, Janus Capital Group

Throughout recorded time in which investment advice has been proffered, there has been a universal admonition to investors not to think that the repeating patterns of the past somehow warrant a different response. That advice has become so ingrained in most investment professionals' minds that it is said that nothing in investing is so dangerous as believing that “this time is different”. We agree.

That has been and, no doubt, will continue to be sound advice. However, recent years have presented a different version of “this time is different”. The backdrop or environment for responding to investment situations is different now than at any time in the history of the United States. Interest rates have never been this low and the infusion of funds into the economy has never been even a fraction of what it has been in recent years. The bottom line is that the same indications of elevated risk that we were used to responding to by getting defensive in the stock market over the years have not been as accurate as warning signs in this different environment. The market’s progress has been undeterred by the risky picture painted by the indicators that had allowed us to escape the major portion of all significant declines since they were put to use in 1978. Stocks and to an extent real estate became the default destination for funds so dam the torpedoes.

We have included the three quotes above from three of the most respected investment minds around today. We are certainly not alone, nor have we been, in assessing the unique actions of the Federal Reserve and the current administration as promoting unsustainable froth in the pricing of assets. Not only have they produced untenable levels of valuation but unfortunately much of their policies are responsible for the increasing separation in the well-being of the population…but that perhaps is a subject for another time.

Disclaimer: While this study is a useful exercise, JLFMI's actual investment decisions are based on our proprietary models. Therefore, the conclusions based on the study in this newsletter may or may not be consistent with JLFMI's actual investment posture at any given time. Additionally, the commentary here should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies.

Reviewing What Makes JLFMI Tick

Although our literature and website describe the tools we use in managing client funds, a refresher might be in order for those who have not reviewed it for some time. Our management tools are basically divided into two parts. One, the Risk Assessment Model, is employed to assist us in determining the amount of risk in the market at the time and therefore, how much exposure -- or risk -- to assume in our investment positioning. The second part, our proprietary Fund Selection Model, gives us the input needed to arrive at what we should be investing in.

A brief explanation of both follows. The discussion may give you some explanation of how the different environment somewhat subverted the approach recently that served us so well for so many years -- and will again as we return to a more historically “normal” environment. That approach more importantly will serve the essential goal of protecting client funds when we correct the artificial levels attained during this unusual period.

Risk-Assessment Model

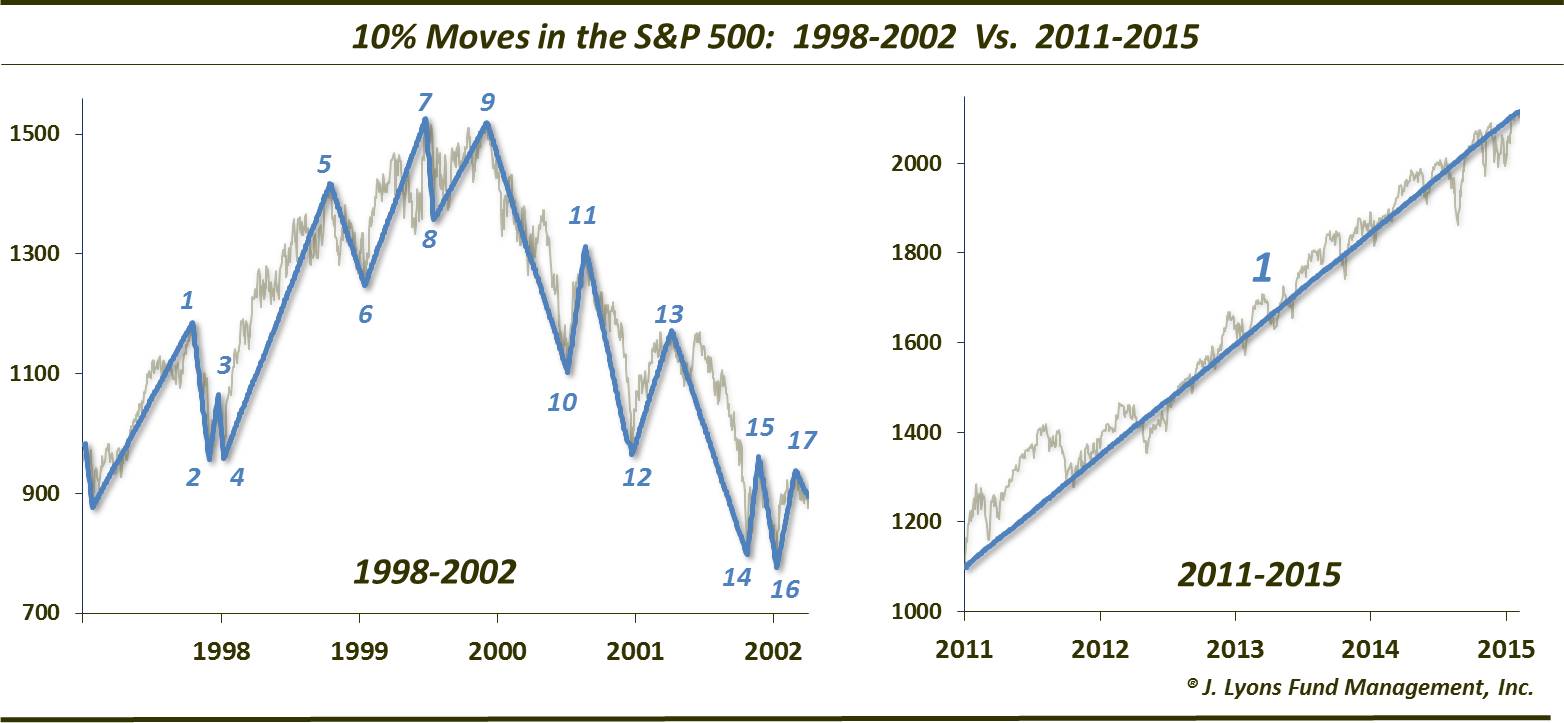

This collection of indicators is derived entirely from data mined directly from the stock market itself. We use the information to measure various segments of the market’s strength over various periods from weekly to what we would term an intermediate time frame. All such indicators have to change directions for a signal to occur. Over the years, that consensus changes about 2 to 3 times a year. A historic view of the market indicates that the market generally has obvious swings in a year matching the change of direction indicated by the model. That has been different in the past 4 years however. During that time, not only have we not had as much as a 10% pullback, but all the pullbacks that we did have snapped back very quickly leaving us, at times, in what became an overly defensive position and dampening returns.

Relative Strength Fund Selection Model

This tool allows us to choose the strongest, best supported conventional mutual funds or exchange traded funds (ETF’s ) from a universe of several thousand choices representing any investment possibility in the world. The investment truism here is that it is far better to buy stocks that are strong than those that are weak, and which probably have good reason for being weak. This model ranks and identifies those strong candidates. The list that we rank contains funds that are structured to profit in rising markets as well as funds that profit in falling markets.

In addition to the models just discussed, we do watch the fundamental factors of the economy, both here and around the world. And although, our analysis of recent years that the recovery would be labored was correct, our conclusions did nothing to counter the fact that low interest rates and the gross quantitative easing by themselves contributed to the market’s excessive strength. I also will hasten to add that our fundamental analysis always takes a secondary position to the results of our models in determining our decisions.

So What Now?

In our opinion, the risk for investors has never been greater

in our memory. As the three gentlemen above state, asset prices are at

unrealistic and therefore untenable levels. At some point, markets

correct those kinds of anomalies and not only correct them but

over-correct. Markets are always inclined to go to extremes. The

excesses may well build even to a greater extent because generally only

somewhat significantly higher rates reverse equity market trends and it

doesn’t appear that the economy will overheat any time soon to justify

such higher rates. Either such a meaningful rise in rates or some

unexpected or outlier event will bring on the next bear market, I would

guess.

The unfortunate thing is that the market has finally been drawing reluctant investors back into it at these high levels and will do so even more if we continue upward. Not only will they come back but will do so thinking as always at or near tops that buying and holding once again is a believable strategy. In fact, for most investors who are drawn in late, buying high and then trying to hold is a recipe for disaster. The major investors, those that have most profited from the rally of the past 6 years will be least affected as they will only give back profits. The class equality chasm will widen and as much as it is a supposed quest of some to reduce it, current policies are continuing and they will only continue to worsen it. That is sad…

John S. Lyons

President

The

commentary

included in this newsletter is provided for informational purposes

only. It does not constitute a recommendation to invest in any

specific investment product or service. Proper due diligence should be

performed before

investing in any investment vehicle. There is a risk of loss involved

in

all investments.

| Tweet |

|

|