J. Lyons Fund Management, Inc. Newsletter

| April 2012 |

Posted April 1, 2012 |

| Tweet |

|

Wall Street's Valuation Myth

Are current P/E ratios actually cheap? Do they even matter? Exposing one of Wall Street’s favorite sales pitches.

A report from us on equity valuations, specifically the price-to-earnings ratio (P/E), has been a long time coming. We have long felt that the "valuation argument" -- that is, recommending a stock or stock market because its price (P) is "cheap" relative to its underlying earnings (E) -- is a technique that is too often relied upon and too seldom reliable. While we do not use fundamental input in our money management, given the ubiquitous nature of this type of analysis, we have wanted to set the record straight for investors about just how useful P/E ratios are...and when they are useful.

After a recent barrage from the Wall Street establishment regarding such "cheap" equity valuations, we could not put it off any longer. In just the past several months, we have heard the following from Wall Street bigwigs:

"Valuations look very cheap."

Jim O'Neill, Goldman Sachs Asset

Management chief

"There are

great values in equities."

Larry Fink, BlackRock CEO (while recommending 100% investment

in

equities)

"From any historical lens, this

P/E multiple appears

conservative"

Thomas Lee,

Stocks

are at "...attractive valuations"

Tobias Levkovich,

Citigroup Chief U.S. Equity

Strategist

"Stocks look cheap."

David Bianco, Deutsche Bank Chief US Equity

Strategist

"It's one of the cheapest

markets I've seen"

Jeremy Siegel, Wharton Finance Professor, stock market pundit and the

inspiration for our March Newsletter:

Now we would not dare counter this consensus opinion from such

a lineup of investment titans on this topic, would we?

Absolutely. In fact, considering there is such a consensus on Wall

Street

that stocks represent a great "value" right now, we feel even more

confident in our side of the argument. Here is the straight,

unbiased scoop on P/E's.

Note: While this study is a useful exercise, JLFMI's actual investment decisions are based on our proprietary models. Therefore, the conclusions based on the study in this newsletter may or may not be consistent with JLFMI's actual investment posture at any given time. Additionally, the commentary here should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies.

Wall Street's "Attractive Valuations" Myth

Short-Term Memory

In managing money for our clients, being students of market history helps us maintain focus on managing risk while pursuing our goal of generating investment growth. By studying history, one can perceive various longer-term patterns or cycles in the market that may not be obvious in the shorter-term. Gaining such perspective can be critical in investing, especially when it comes to controlling risk. This is also an area of deficiency in the Wall Street establishment's valuation argument.

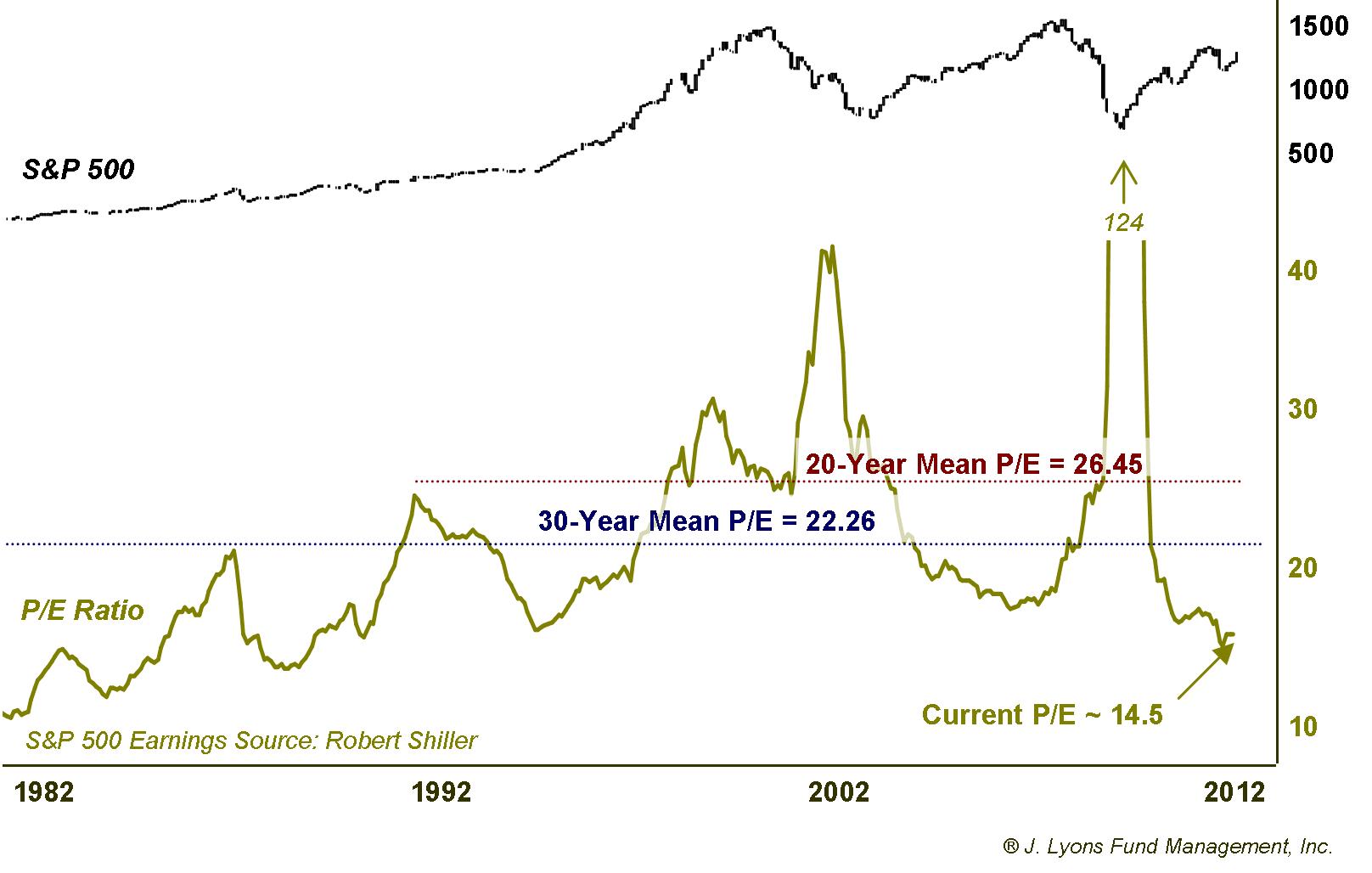

The most noticeable flaw in Wall Street's case that P/E ratios are cheap stems from a lack of historical perspective. Many Wall Street pundits are either unaware of, or dismissive of, the longer-term valuation history. This lack of perspective leads to inappropriate or insufficient historical comparisons. In this case, they resort to making comparisons versus only recent P/E readings, or only use as long a look-back period as will provide support for their "cheap valuation" case.

For

example, Fink bases his "cheap" call based on valuations of just the

past "20 to 30 years". Likewise, JP Morgan's Chief Market Strategist

David Kelly recently called valuations extreme because they were at

"some of the lowest earnings multiples seen in the last two decades".

As shown below, according to these limited-duration comparison

measures, current valuations appear "cheap".

At

around 14.5 as of the end of 2011, the P/E ratio on the S&P 500

was

at a 30+% discount to its 30-year mean and over 40% discounted from

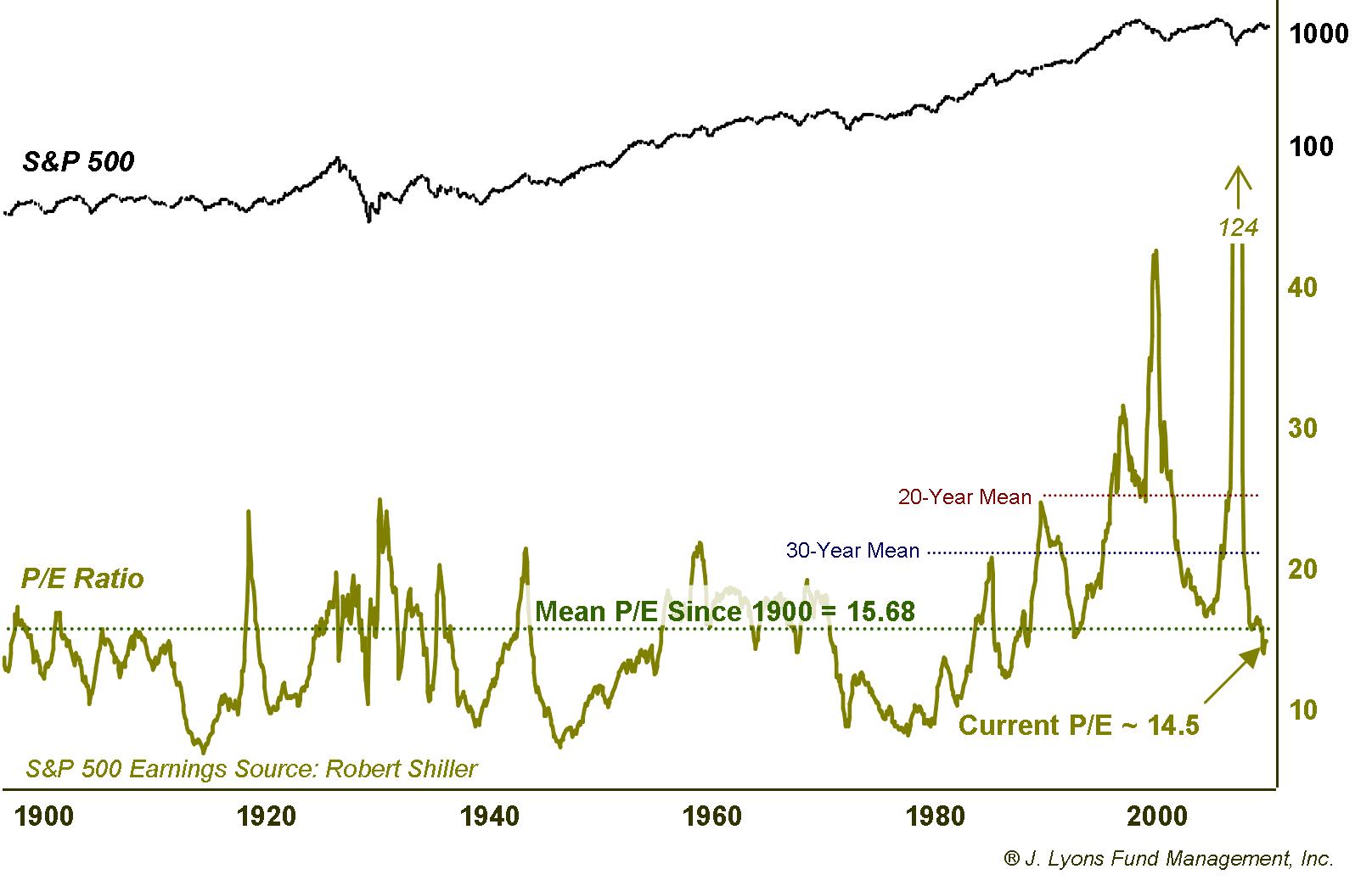

its 20-year mean. In reality, if you zoom out and look at the long-term

history of the P/E ratio, current readings do not seem so relatively

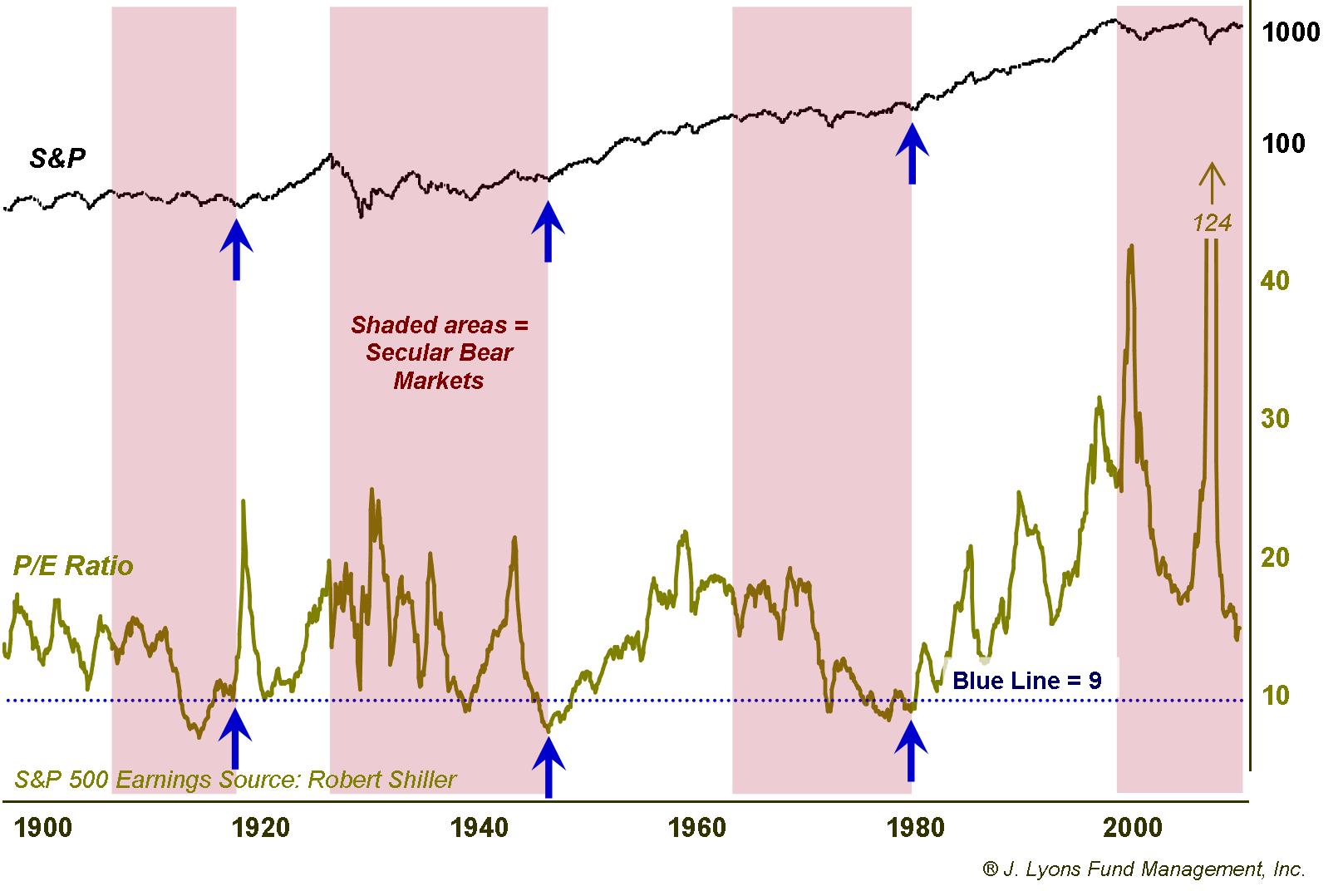

cheap. Here is the bird's-eye view, since 1900.

From

this more comprehensive view, P/E's don't look so cheap. At just under

the mean of the last 112 years, valuations may not be expensive

historically, but they certainly cannot be considered "cheap" by any

reasonable measures. This is an inconvenient fact for those promoting

stocks based on the valuation argument. That is why they refer only to

recent history for comparisons -- it makes for an easier sell. Case in

point, Bianco

argues that a relevant comparison should not go back before

the 1960's because, in his words, the Great Depression and two World

Wars dampened P/E ratios (duh!).

Also keep in mind, the latest reading of 14.5 on the chart is as of the end of the year, before the 12% rally in the S&P 500 (P). Even if earnings growth has kept pace in the first quarter of 2012, the current P/E would be somewhere in the low 15's. For those giants of Wall Street to be arguing that valuations are cheap at this point is, to use a baseball analogy, sort of like arguing that a .300 hitter is due for a hot streak when his average drops from .320 to .298.

In reality, averages are, by definition, derived from equal readings above and below that point. Therefore, a move to just below average does not mean valuations are destined to spike back up. And indeed, as we have pointed out many times, historically when data goes to an extreme in one direction, it typically will move to the opposite extreme before the cycle is complete.

Creative Accounting

Another favorite tendency of Wall Street cheerleaders, er, strategists, is to apply all sorts of accounting gimmicks to their earnings calculations that make stocks appear more attractive. Whether it's using simply operating earnings, pro-forma earnings or earnings before interest, taxes, depreciation and amortization, those with a vested interest in having stocks appear cheap will find a way to make them appear so.

There is of course always some sort of justification for using alternative calculations -- usually a variation of "this time is different". Just before the dot com bubble burst in 2000, for example, some on Wall Street began to justify sky-high valuations by saying that companies didn't need earnings, only some measure of sales growth. We know now how "un-different" those times ended up.

One of the preferred methods for lowering P/E's on Wall Street is to use forward earnings estimates instead of the actual trailing earnings that are used in traditional P/E calculations, as in the charts above. By using forward estimates, stock promoters can essentially come up with whatever P/E ratio they want by plugging in the necessary "earnings" figure for the following year or 2 years or whenever. After a year or two, nobody remembers their earnings estimates anyway so they don't get held accountable. Not a bad gig.

Revisionist History

In addition to creative accounting and short-term memory, Wall Street also has a penchant for revising historical data to make today's valuations look cheap or to justify why valuations should be higher now. This maneuver, however, is also typically a variation of the "this time is different" argument and it reminds us of Winston Churchill's quote "these are the opinions upon which I base my facts."

For instance, Siegel, and others, suggest "massaging" (that sounds much more harmless than "changing") historical P/E readings to adjust for interest rates. This makes it much easier for them to argue that today's valuations are indeed cheap given the prevailing rock-bottom interest rates. However, interest rates in the 1930's-40's were generally as low as they are now yet they did not support high P/E levels back then. Nor did they support high equity returns as that was the last time the stock market went two decades without any price appreciation. Sound familiar? Maybe that's why the analysts do not recommend comparing P/E levels from before 1960.

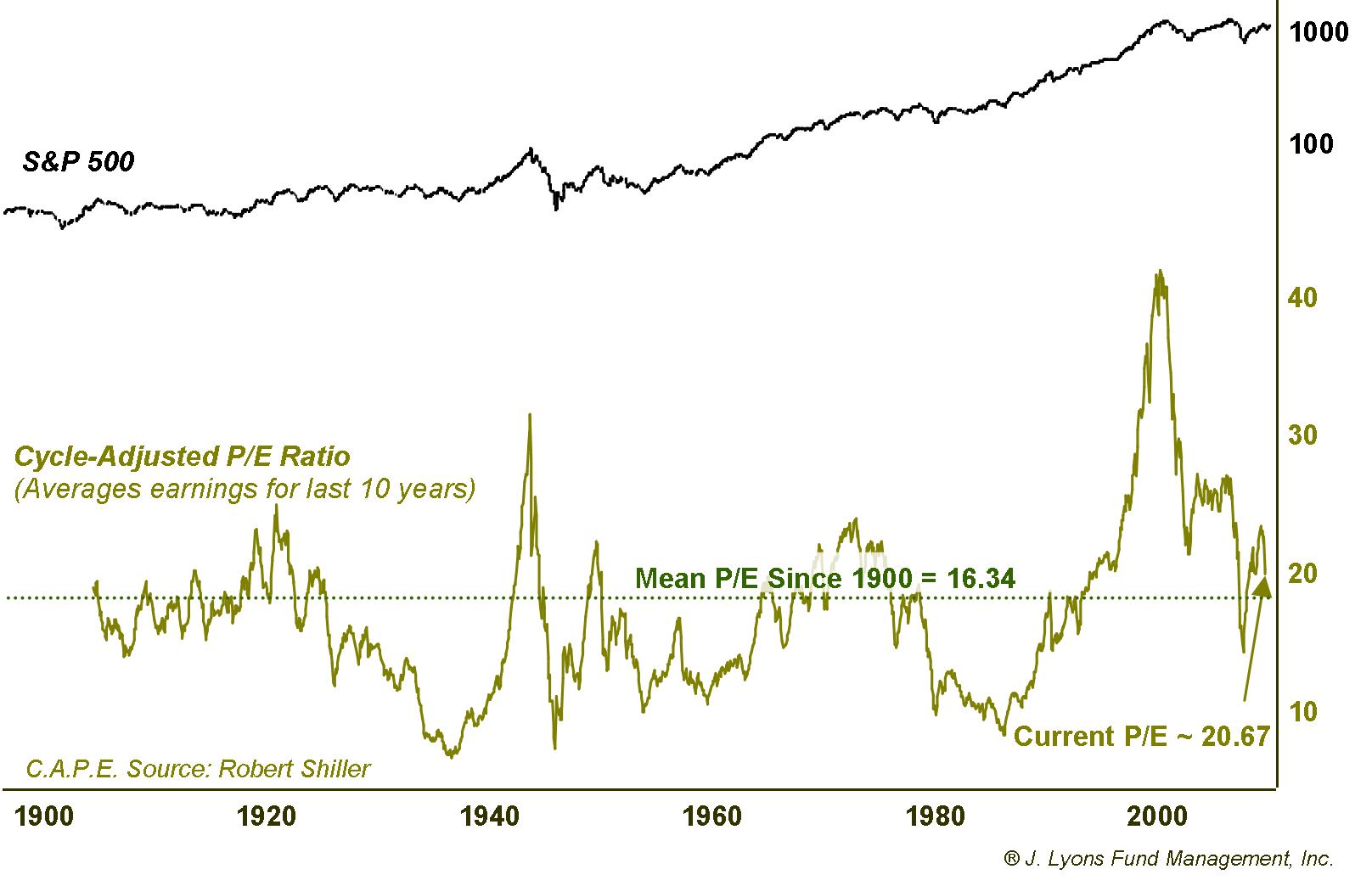

There may be well-reasoned arguments for making adjustments to P/E calculations; however, "this time is different" and "the data doesn't agree with my agenda" do not qualify. Perhaps one reasonable justification for making an adjustment is in order to smooth out large, short-term distortions in the data due to transitory shocks (by the way, does anyone else think that economists have taken to using the word 'transitory' to mean "not proceeding as planned" instead of "temporary"?). For example, the spike in the P/E ratio up to 124 in 2009 due to the temporary evaporation of earnings during the financial crisis would qualify as a short-term distortion.

One technique is to use a cycle-adjusted P/E ratio which takes an average of past earnings in order to smooth out temporary distortions. The most popular example of this method is Yale Professor Robert Shiller's Cycle-Adjusted Price/Earnings ratio, or C.A.P.E. However, according to its calculations, current valuations appear more expensive today. Therefore, the low-valuation crowd is not too fond of using C.A.P.E. and has taken to attacking its methodology.

We

prefer to just keep it simple for the sake of this study and use the

pure, unaltered price/earnings ratio. It allows for apple-to-apples

historical

comparisons and also removes all biases, intended or otherwise, that

might enter into the data through adjustments. It leaves

one to judge valuations strictly on the objective, statistical evidence

instead of potentially arbitrary or

subjective input that may be included merely to justify a desired

conclusion.

Allowing such biases into the data can lend itself not only to inaccuracy but, even worse, to poor investment decisions. Perhaps the fact that modern P/E's have been persistently high is indicative of larger, yet-unresolved issues. Could all of the Fed-induced easy money be propping up prices and lengthening or delaying the healing process that accompanies a secular decline? And perhaps all of the accounting gimmicks that have become commonplace have given the investment community a false sense of security in accepting higher P/E's when economic prospects are actually bleaker than they appear.

What Are Truly "Low" Valuations...or, When do Valuations Actually Matter?

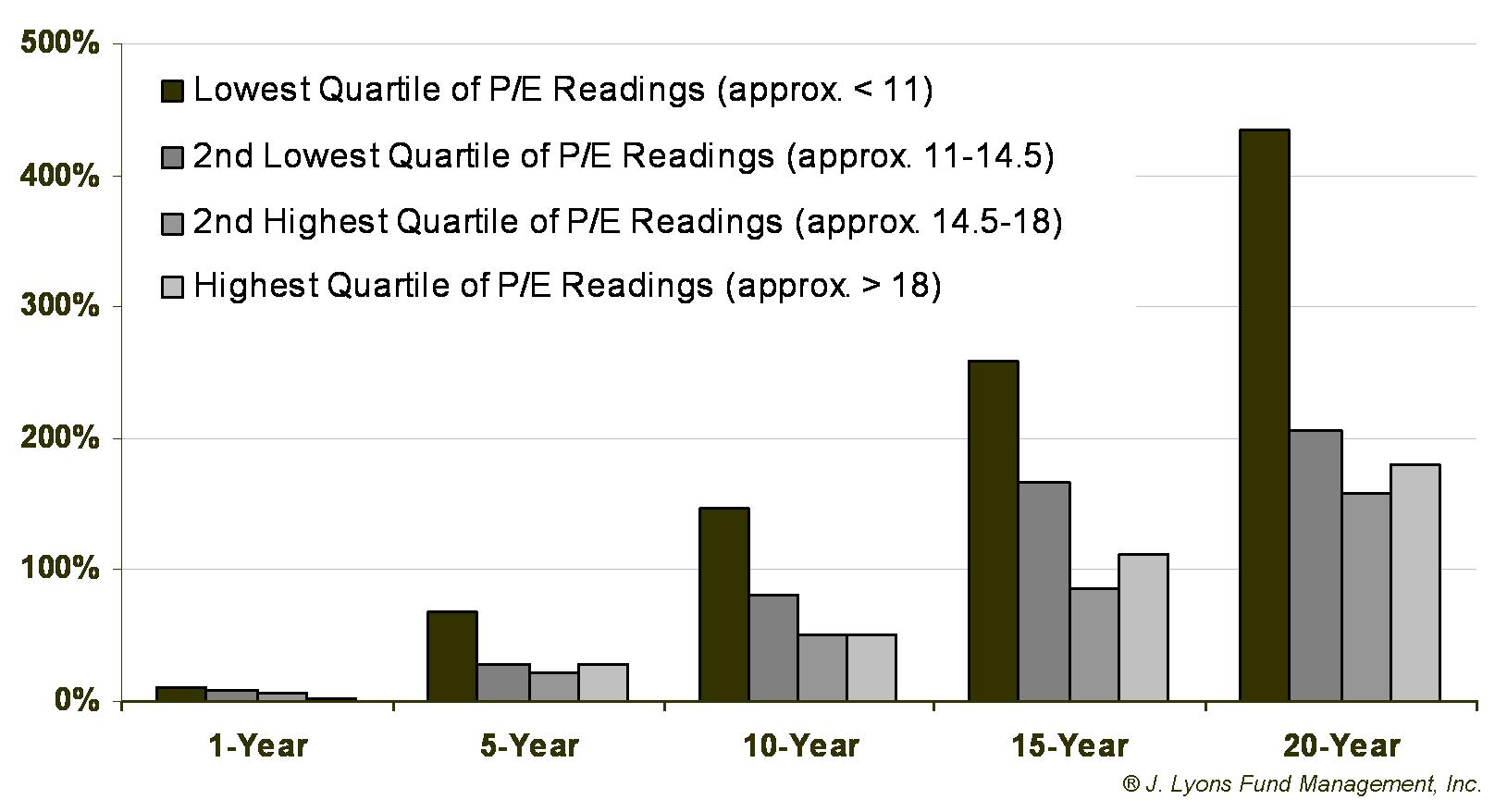

By reasonable and objective standards, current valuations are roughly around their long-term average, certainly not cheap. So what P/E level can be considered "cheap" or "attractive"? All too often, cheap has merely meant low or below-average in price, regardless of the stock's prospects for gains. From our perspective, "cheap" or "attractive" must mean that investors are getting a value by buying stocks at that level, i.e., they stand a good chance of achieving a good rate of return. Otherwise what good is "cheap"?

Historically, we have found that the stock market's future prospects are much more dependent upon the secular environment present at the time than valuations. In fact, valuations have meant very little to the market's forward returns until P/E's have fallen into at least the lower quartile of historical readings. Look at the returns since 1900 following the various levels of P/E readings:

Besides

the obvious out-performance following P/E readings in the lowest

quartile historically, the other takeaway from this chart is the lack

of separation among the returns following each of the other quartiles.

We intentionally displayed the total returns rather than annualized

returns to illustrate that point more clearly. If valuations (other

than at extremely low levels) really had a significant effect on market

returns, one would expect to see a more sloped distribution between

each of the quartiles. These results would seem to strongly

support our contention that returns are much more dependant

upon the secular market environment than on valuation.

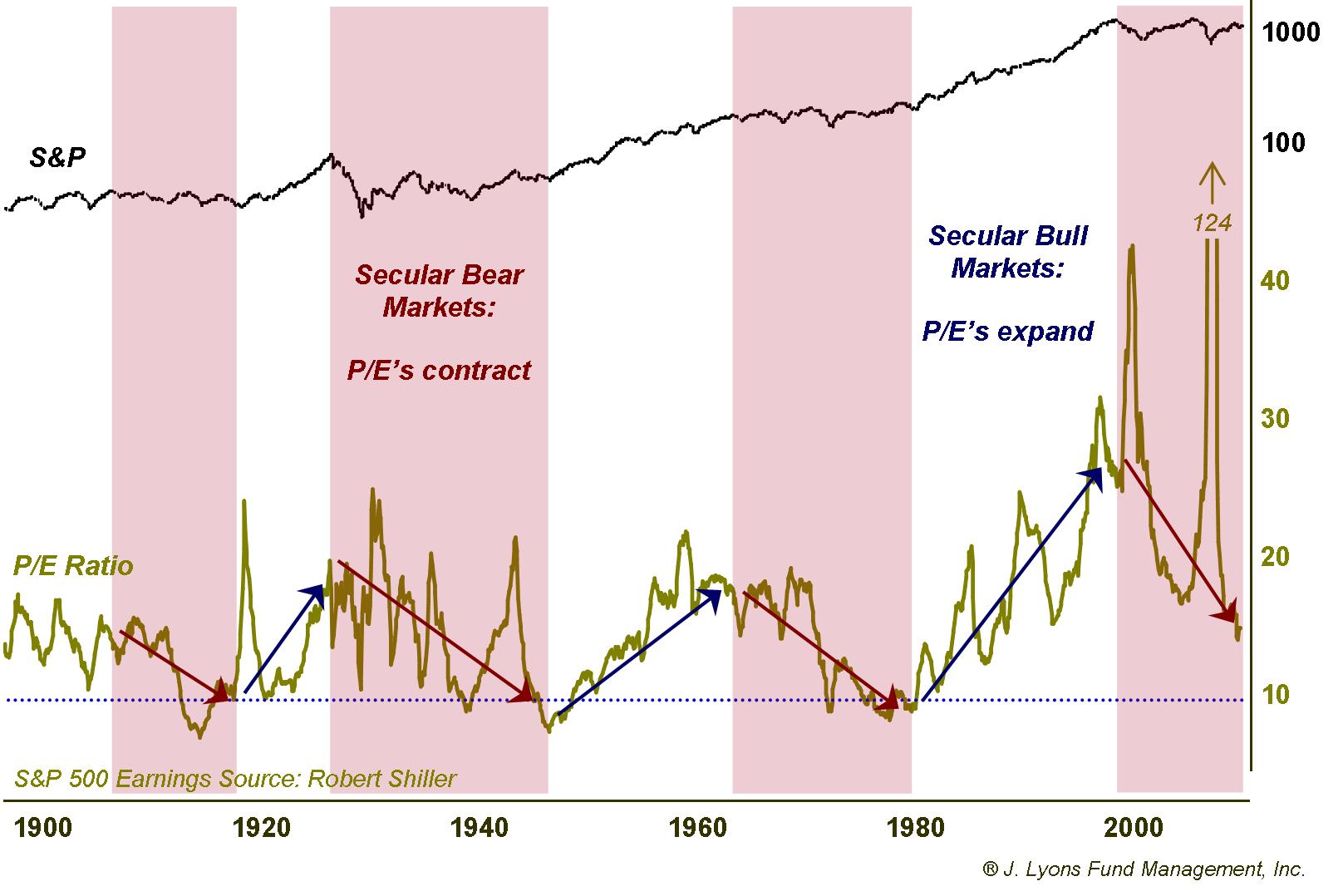

When it comes to truly "attractive" valuations, the most reliable and profitable signals have been those low P/E extremes which marked the end of secular bear markets. Prior to the beginning of each of the secular bull markets of the past century, P/E levels have fallen below 7 at some point and were below 9 at the time the secular bulls commenced.

As

seen in the chart, the P/E cycle has regularly bottomed out in the

single digits. These readings, not coincidentally, have corresponded

with the ending of secular bear markets. For valuation-based investors,

these have been the times to buy. While there were a few extreme P/E

spikes lower in the middle of secular bears in the 1930's and 1970's

due

to sharp drops in equity prices, those only provided for good

temporary buy signals. The low P/E

readings that marked the end of secular bears were a

result of long-stagnant prices (P's) along with steadily rising

earnings

(E's). Such conditions allowed for the launching of new secular bull

markets and were an economic boon to investors:

| 1-Year | 5-Year | 10-Year | 15-Year | 20-Year | |

| P/E Readings Below 9 | 10.8% | 68% | 173% | 290% | 546% |

| Average of All Periods | 6.9% | 37% | 85% | 163% | 260% |

What (If Anything) Do Current Valuations Mean?

If valuations are really only useful to buyers at extreme lows at secular market bottoms, what use are they during the 30+ years in between while we wait? Should they be completely dismissed? Our short answer is "sure". However, let's attempt to get some value out of the interim data...no pun intended.

As indicated, current P/E readings lie squarely in the middle of their historical range. How has the market reacted after similar historical readings? We've already shown that any P/E readings that were not at extremely low levels have resulted, on average, in similar, subdued returns no matter how far above the low extremes they were. Therefore, we need to somehow segment the data further in order to find possible useful patterns.

Like much of the research that we've produced in recent years, the distinguishing factor in forecasting future returns appears to be the secular market cycle. The level of the P/E ratio is less important than whether stocks are in the midst of a secular bull or bear market. Secular bulls are supportive of rising P/E's as economic, business and/or investment expansion unfolds. On the other hand, during secular bears, the deleveraging and de-risking process causes P/E levels to contract, eventually reaching those low extremes we pointed out above.

Again, the level of P/E is not as important for stock returns as the market's position in the secular cycle. We looked at P/E readings similar to current levels and measured subsequent returns based on whether they fell within a secular bull or bear market. While none of the returns were spectacular, the existence of a bull or bear market made a significant difference, especially in the shorter-term:

| 1-Year | 5-Year | 10-Year | |

| P/E Readings Between 12-17 in Secular Bull Markets | 11.2% | 6.5% | 6.5% |

| P/E Readings Between 12-17 in Secular Bear Markets | 2.7% | 1.6% | 3.1% |

So, while current P/E's do not constitute a buy signal for stocks, the market can rise with valuations at these levels. However, the existence of a secular bull market would greatly enhance those prospects. Unfortunately, a secular bear market continues to persist today and thus, Wall Street's "cheap" market will likely only get cheaper.

Conclusion

Market Analysis

Despite the drumbeat from Wall Street about "cheap" stocks and "attractive" valuations, actual, unaltered P/E ratios are only slightly below their long-term mean. While the stock market has risen with P/E's at this level in the past, it has been during secular bull markets when P/E's were expanding along with stocks. That process has only unfolded after excesses from the previous bull cycle had been wrung out and low P/E extremes had been reached. Such P/E extremes, i.e., below 9, have historically constituted the only reliable harbinger of a sustainable long-term rally in equities. Will the P/E ratios fall that low before the next secular bull market commences? We cannot guarantee it but we would be willing to bet that once this secular bear ends, P/E's will have reached much closer to that level than where they are now.

Investment Principle

When you hear someone saying to invest in stocks because they are "cheap" or that "valuations are attractive", consider the source. Do they or their firm get paid based on the amount of assets invested in their stock funds? If so, take their "valuation" argument with a grain (or shaker) of salt. If their compensation is tied to your money being invested in stocks, they can likely find a way to make stocks look "cheap". Their sales pitch, however, may be based on creative accounting and/or limited historical comparisons and probably cannot even show results to back up their argument for buying stocks.

Until P/E readings drop further to historically extreme levels, valuation is not a legitimate argument for buying stocks. We would caution you against heeding the story that Wall Street has been telling -- to buy stocks because they are "cheap" even as they have gotten cheaper and cheaper over the last 12 years. Our best advice is to find a money manager or advisor who will proactively put your money where they feel it is best suited at a given time instead of always finding an excuse to put it into "cheap" stocks.

Dana Lyons

The

commentary

included in this newsletter is provided for informational purposes

only. It does not constitute a recommendation to invest in any

specific investment product or service. Proper due diligence should be

performed before

investing in any investment vehicle. There is a risk of loss involved

in

all investments.

| Tweet |

|